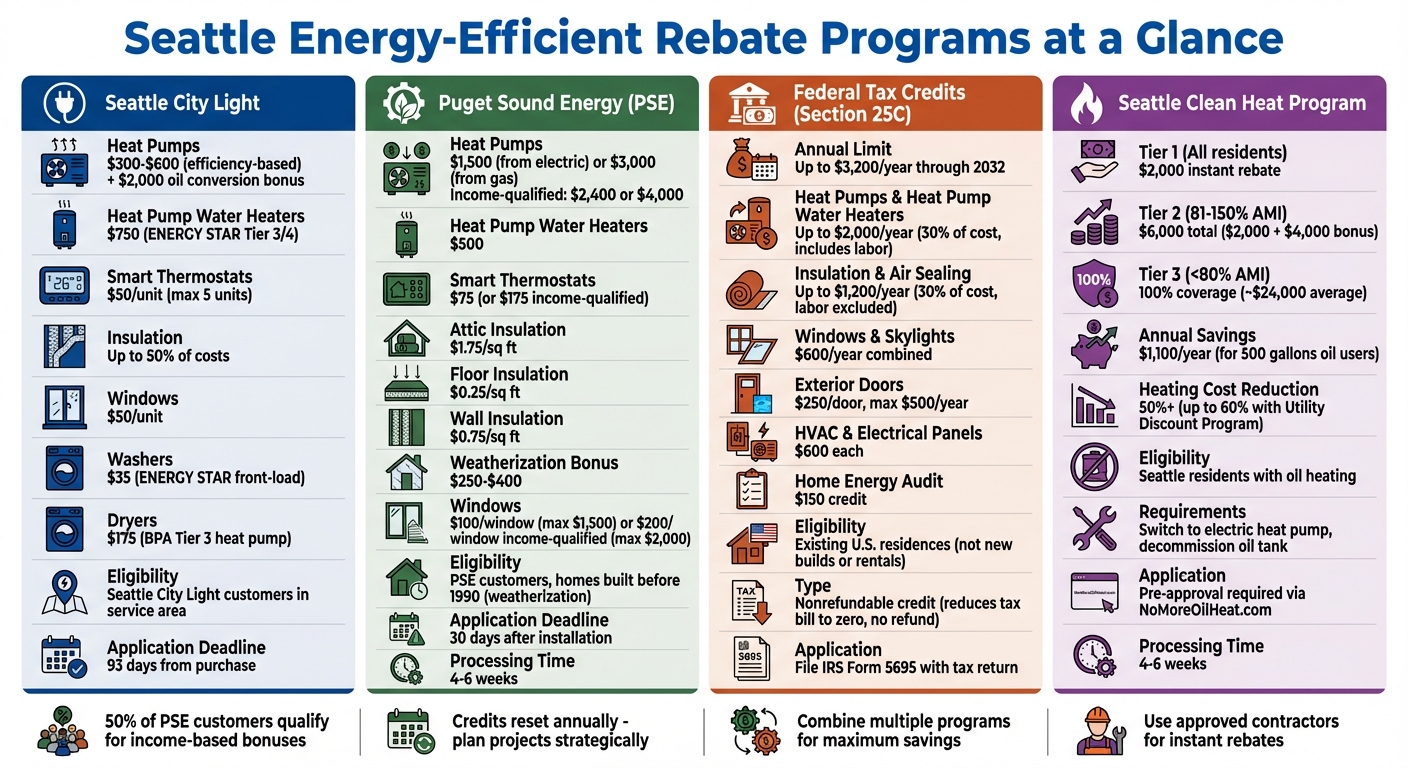

Seattle homeowners can save thousands on energy-efficient upgrades through rebates and tax credits offered by local utilities, city programs, and the federal government. These programs cover costs for heat pumps, insulation, water heaters, and more, making energy upgrades more affordable. Here’s a quick summary:

- Seattle City Light offers rebates for heat pumps ($300–$6,000), water heaters ($750), insulation (up to 50% of costs), and smart thermostats ($50/unit).

- Puget Sound Energy (PSE) provides rebates for heating systems, insulation, and appliances, with bonuses for income-qualified households.

- Federal tax credits allow you to claim 30% of energy-efficient improvements, up to $3,200 annually.

- The Seattle Clean Heat Program helps residents switch from oil to electric heating, covering up to 100% of costs for low-income households.

To qualify, you must meet eligibility requirements, such as being a utility customer, using approved contractors, and ensuring equipment meets efficiency standards. Combining these incentives can significantly reduce upfront costs while lowering energy bills long-term.

Seattle Energy Rebate Programs Comparison: City Light, PSE, Federal Tax Credits & Clean Heat

- Seattle City Light Rebate Eligibility

- How to Qualify for Puget Sound Energy (PSE) Incentives

- Federal Energy Efficiency Tax Credits

- Seattle Clean Heat Program

- Choosing Qualifying Energy Equipment

- Mayor Harrell unveils bonus rebates for heat pump upgrades

- How to Apply for Rebates

- Combining Rebates with Envirosmart Solution Services

- Conclusion

- FAQs

- Related Blog Posts

Seattle City Light Rebate Eligibility

Seattle City Light Rebate Programs

Seattle City Light provides a variety of rebates to help homeowners improve energy efficiency. For heating and cooling, rebates for air-source heat pump installation range from $300 to $600, depending on efficiency levels. Additionally, homeowners converting from oil heating to an electric heat pump system can receive a $2,000 instant rebate.

In the water heating category, heat pump water heaters meeting ENERGY STAR Tier 3 or Tier 4 standards qualify for a $750 rebate. When it comes to appliances, ENERGY STAR front-load washers earn a $35 rebate, while BPA Tier 3 heat pump dryers qualify for $175.

Smart thermostats designed for electric baseboard or fan-forced heaters offer a $50 rebate per unit, with a maximum of five units per household. For weatherization, homeowners can get up to 50% of the costs covered for insulation upgrades in areas like attics, floors, and basements. Energy-efficient windows are eligible for a $50 rebate per unit.

Eligibility Requirements for Seattle City Light

To qualify for these rebates, homeowners must meet specific service, equipment, and installation requirements. Most rebates are available only to Seattle City Light residential customers living within the utility’s service area, which includes Seattle and parts of nearby cities such as Bellevue, Burien, Renton, Shoreline, and Tukwila. Applicants will need their 10-digit Seattle City Light account number to apply.

Eligibility is also dependent on your heating system. For example, rebates for smart thermostats are limited to homes with electric heating controlled by line-voltage thermostats. Homes heated by gas should look into programs offered by Puget Sound Energy. The Clean Heat Program, on the other hand, requires switching from oil heating to a qualified electric heat pump system.

For heat pump rebates, installation must be completed by a participating contractor to qualify for the instant discount – DIY installations are not eligible. However, for heat pump water heaters, both contractor-installed and DIY options are available. Digital coupons for DIY purchases can be redeemed at select retailers like Lowe’s and Home Depot.

Lastly, all equipment must meet specific standards. For example, washers must have ENERGY STAR certification, and heat pump water heaters must meet Tier 3 or Tier 4 ratings. Before purchasing, ensure the product is listed on Seattle City Light’s qualified product list. If applying for post-purchase rebates, you’ll need to submit an online form along with your invoice within 93 days of purchase.

sbb-itb-8db64ac

How to Qualify for Puget Sound Energy (PSE) Incentives

Available PSE Rebates

If you’re a homeowner in parts of the Greater Seattle area served by Puget Sound Energy (PSE) for natural gas or electric service, there’s a variety of rebates available to help make your home more energy-efficient. These rebates cover upgrades like heating systems, insulation, and even appliances.

For example, PSE offers $1,500 for switching from electric resistance heating to a ductless heat pump and $3,000 for converting from natural gas. If you meet income qualifications, these rebates increase to $2,400 (electric) or $4,000 (gas). Interestingly, about 50% of PSE customers fall into these income-qualified tiers.

When it comes to insulation, the rebates break down as follows: $1.75 per square foot for attic insulation upgrades (R-11 to R-49), $0.25 per square foot for floor insulation, and $0.75 per square foot for wall insulation. Plus, if you combine multiple weatherization upgrades, you could earn an extra $250 to $400 as a bonus.

Other rebates include:

- $500 for heat pump water heaters

- $75 for smart thermostats (or up to $175 for income-qualified customers)

- $100 per window for replacing single-pane windows with models rated U-0.22 or lower, capped at $1,500 per home. Income-qualified customers can receive $200 per window, up to $2,000 total.

Next up: how to make sure you meet the requirements to claim these rebates.

Meeting PSE Rebate Requirements

To qualify for these rebates, there are a few key requirements to keep in mind.

First, you must be a PSE residential customer in their electric or natural gas service area. Rebates are available for existing single-family homes, as well as manufactured or mobile homes.

Equipment standards are specific. All upgrades must be new and meet efficiency benchmarks, such as being AHRI Certified® or ENERGY STAR® rated. For weatherization rebates, your home must have been built before 1990, and attic insulation rebates require that your current insulation is 0 to 4 inches thick (R-11 or less).

Installations must be completed by a PSE-approved contractor. For advanced duct sealing projects, you’ll need an Aeroseal-certified contractor.

Once the installation is complete, submit your rebate application within 30 days. Be sure to include a paid invoice or receipt detailing the purchase date, itemized costs, and installation date. For window rebates, you’ll also need to save the NFRC stickers as proof of compliance. Processing typically takes about 4 to 6 weeks. Keep in mind that most programs limit rebates to one home heating rebate and one water heating rebate per residence.

For questions or assistance, contact PSE’s energy advisors at 1-800-562-1482 (Monday–Friday, 8 a.m.–5 p.m.). You can also check if you qualify for the Efficiency Boost program by using PSE’s online income eligibility calculator before applying.

Federal Energy Efficiency Tax Credits

Understanding the Section 25C Tax Credit

If you’re a Seattle homeowner, you can lower your federal income taxes by claiming 30% of qualifying energy-efficient home improvements under the Section 25C tax credit.

Here’s how it works: this credit isn’t a one-time deal – it resets every year, allowing you to claim up to $3,200 annually through 2032. That includes up to $2,000 per year for heat pumps, heat pump water heaters, and biomass stoves, plus up to $1,200 annually for improvements like insulation, energy-efficient windows, and doors.

Keep in mind, this is a nonrefundable credit, meaning it can reduce your tax bill to zero but won’t result in a refund or carry over to future years. The credit can be combined with local utility incentives, making energy upgrades even more affordable for Seattle residents. Starting in 2025, you’ll need to ensure your equipment comes from a "qualified manufacturer" and include a Qualified Manufacturer Identification Number (QMID) on your tax return.

To qualify, your home must be an existing U.S. residence – this credit doesn’t cover new builds or rental properties where you don’t live. If you’re switching from oil or gas heating, you can stack this federal credit with local programs like the Seattle Clean Heat initiative or rebates from Seattle City Light and Puget Sound Energy for additional savings.

The next section breaks down which specific improvements qualify for these credits.

Qualifying Improvements for Federal Tax Credits

Certain upgrades offer higher credits than others. For instance, heat pumps and heat pump water heaters can earn you up to $2,000 annually, provided they meet the Consortium for Energy Efficiency (CEE) highest efficiency standards. Even better, the installation labor costs for these systems are eligible for the credit.

Insulation and air sealing projects qualify for up to $1,200 per year, as long as they meet International Energy Conservation Code (IECC) standards. However, labor costs for these improvements don’t count toward the credit. To get the most out of your investment, consider a home energy audit first – it’s eligible for a separate $150 credit and helps pinpoint areas that need sealing or insulation.

Other improvements have specific caps:

- Exterior windows and skylights: Combined annual limit of $600, must meet Energy Star Most Efficient standards.

- Exterior doors: $250 per door, up to $500 annually.

- Central air conditioners, furnaces, boilers, and electrical panel upgrades (200+ amps): Each qualifies for up to $600.

To claim these credits, file IRS Form 5695 with your federal tax return. Be sure to save all receipts, Energy Star labels, and manufacturer certifications for at least three years. Since the credit resets every year, you can plan your projects strategically – for example, tackle insulation and windows one year, then install a heat pump the next – to maximize your overall tax savings.

Seattle Clean Heat Program

Rebates for Oil-to-Electric Conversions

Seattle’s Clean Heat Program offers three rebate tiers to help residents switch from oil-based heating to electric heat pumps. Every Seattle resident qualifies for a $2,000 instant rebate, applied directly to the contractor’s invoice – no income restrictions apply. For households earning between 81% and 150% of the Area Median Income (AMI), there’s an additional $4,000 rebate, bringing the total savings to $6,000. If your household earns less than 80% of AMI, the program covers the entire conversion cost – an average value of $24,000 – including the heat pump, installation, and oil tank decommissioning.

"Burning oil for heating is not only costly to our planet, but also to our residents’ health and monthly expenses."

- Mayor Bruce Harrell

Switching to an electric heat pump can reduce annual heating costs by more than 50%, saving households using 500 gallons of oil about $1,100 per year. Additionally, households enrolled in the Utility Discount Program could see up to a 60% reduction in electric heating costs. Below is a guide to income limits for rebate eligibility:

| Household Size | Lower Income Limit (81% AMI) | Upper Income Limit (150% AMI) |

|---|---|---|

| 1 | $84,850 | $165,000 |

| 2 | $96,950 | $188,550 |

| 3 | $109,050 | $212,100 |

| 4 | $121,150 | $235,650 |

| 5 | $130,850 | $254,550 |

| 6 | $140,550 | $273,400 |

| 7 | $150,250 | $292,250 |

| 8 | $159,950 | $311,100 |

How to Join the Clean Heat Program

To participate, visit NoMoreOilHeat.com to find approved contractors, request free estimates for a Mitsubishi electric heat pump, and compare at least three bids to ensure competitive pricing. After selecting a contractor, complete the Homeowner Participation Form and submit it before installation begins.

For the conversion process, contact the Seattle Office of Housing with your 10-digit Seattle City Light account number, proof of residency, and income documentation for the last three months. The city oversees the entire project, including a home energy audit, contractor selection, and project management. Applications are typically reviewed within 4–6 weeks.

Decommissioning your oil tank is a required step and must meet Seattle Fire Department regulations. If a leak is found during decommissioning, the WA State Pollution Liability Insurance Agency provides grants and loans of up to $75,000 for cleanup costs on registered tanks. The city aims to transition the estimated 8,000 to 10,000 oil-heated homes to electric heating by 2030. By completing these steps, you could enjoy substantial energy savings and lower heating costs.

Choosing Qualifying Energy Equipment

Equipment Eligible for Rebates

If you’re in Seattle, heat pumps come with some solid rebate options. Models rated at SEER2 15.2 and HSPF2 8.1 are eligible for a $300 instant discount, while higher-efficiency models – those with SEER2 16.0 and HSPF2 9.5 – qualify for a $600 discount. These systems not only save you money upfront but can also cut your heating costs by 25% to 50% compared to standard electric heating systems.

Other upgrades, like weatherization improvements, can also reduce energy costs. Enhancing attic or floor insulation and improving air sealing can lower heating and cooling expenses by about 15%. Upgrading to high-performance windows with lower U-factors can trim energy bills by up to 12%. Even small changes, such as installing smart thermostats (rebated at $50 each, up to five units) or thermostatic shower shut-off valves ($15 each, up to three), qualify for rebates and help manage energy usage.

Once you’ve picked your equipment, it’s crucial to confirm that it meets the necessary standards for rebates.

Verifying Equipment Meets Standards

Before making a purchase, double-check that your chosen equipment is eligible for rebates. Start by consulting the Qualified Products List (QPL) maintained by Seattle City Light or Puget Sound Energy. For heat pumps, ensure the model is AHRI Certified and meets the minimum efficiency ratings required for the rebate tier you’re targeting. Water heaters must carry the ENERGY STAR® certification and be classified as Tier 3 or Tier 4 to qualify.

For windows and patio doors, hold onto NFRC stickers or packing slips that confirm a U-factor of 0.30 or lower, as this is required for rebate eligibility. Federal tax credits tend to have even stricter requirements – windows and skylights, for example, must meet the ENERGY STAR Most Efficient standards, and central air conditioners or furnaces need to fall within the highest CEE tier.

To avoid any surprises, contact a Seattle City Light Energy Advisor or call Puget Sound Energy at 1‑800‑562‑1482. If you’re working with a contractor, consider choosing one who sources equipment through participating distributors. This ensures eligibility and allows for instant discounts to be applied directly to your invoice.

Mayor Harrell unveils bonus rebates for heat pump upgrades

How to Apply for Rebates

Once you’ve confirmed that your equipment qualifies, it’s time to move forward with the rebate application process.

Required Documentation

Start by gathering all the necessary paperwork. This includes purchase receipts and retail invoices that clearly show the date, price, and model numbers of the equipment you purchased. If you’re applying for federal credits, you’ll also need a manufacturer’s certification confirming that the equipment meets ENERGY STAR or CEE tier standards.

If a contractor handled the installation, make sure to keep their invoice. For programs like Seattle City Light’s heat pump rebates, the contractor’s invoice must specifically show the instant discount that was passed on to you. Some rebate programs may also require professional inspection reports, so it’s smart to double-check the specific requirements for your utility before applying.

For federal tax credits, you’ll need to file IRS Form 5695 (Part II) along with your annual tax return to claim credits for home improvements. Be sure to store all your documents safely in case verification is required.

Submitting Your Application

Seattle City Light offers several ways to claim rebates: contractor-applied instant discounts, DIY digital coupons, or an online post-purchase form. If you’re opting for the DIY route with a heat pump water heater, download the $750 digital coupon before heading to the store. Alternatively, submit the online rebate form with an image of your retail invoice within 93 days of purchase.

For Puget Sound Energy rebates, most require installation by a Recommended Energy Professional (REP), with contractors often applying the discount directly to your invoice. Keep in mind that processing these rebates typically takes 4 to 6 weeks, so plan ahead. You can check the status of your application by contacting PSE at 1-800-562-1482.

Federal tax credits operate differently – you’ll claim these annually when filing your taxes instead of through a utility program. For Washington State’s Home Electrification and Appliance Rebates (HEAR), pre-approval is mandatory before starting any work. This process is managed by Guidehouse, a third-party administrator. Any work completed before receiving program approval won’t qualify for retroactive rebates.

| Program/Utility | Submission Method | Processing Time |

|---|---|---|

| Seattle City Light (DIY) | Online form or digital coupon | Instant or within 93 days |

| Seattle City Light (Contractor) | Instant discount on invoice | Immediate |

| Puget Sound Energy | Contractor-led or online application | 4–6 weeks |

| Federal Tax Credits | IRS Form 5695 with tax return | Annual filing |

| WA State IRA Rebates | Pre-approval via Guidehouse portal | Varies |

Combining Rebates with Envirosmart Solution Services

![]()

How Envirosmart Solution Helps Maximize Rebates

Navigating the maze of rebate programs from Seattle City Light, Puget Sound Energy, federal tax credits, and state incentives can feel overwhelming. That’s where Envirosmart Solution steps in, taking the guesswork out of the process. They identify all the rebates your project qualifies for and ensure your equipment meets the required efficiency standards.

As a contractor participating in programs like the Seattle Clean Heat Program, Envirosmart Solution applies instant rebates directly to your invoice. This means you don’t have to wait weeks for reimbursement – you see the savings right away. For moderate-income households, this can add up to as much as $6,000 when combining base rebates with additional bonus incentives.

They don’t just stop at finding rebates – they handle the paperwork, from filling out applications to providing equipment documentation. By combining local utility rebates with federal tax credits, they help significantly reduce your overall costs. For example, installing a heat pump could qualify for a $600 Seattle City Light instant rebate alongside a 30% federal tax credit (up to $2,000). Together, these savings can make a big difference.

This hassle-free approach ensures you not only save money upfront but also set the foundation for long-term energy efficiency.

Maintenance Plans for Energy Efficiency

After installation, keeping your system running efficiently is key to maintaining your rebate benefits. While upfront rebates are great, the real savings come from ensuring your system performs well over time. Envirosmart Solution offers maintenance plans designed to keep everything in top shape.

Their SMART GOLD™ annual maintenance package, priced at $699, covers all your home systems. This includes furnace inspections, air duct cleaning, dryer vent servicing, and attic and crawl space checks. Plus, you get a 20% discount on additional services and priority scheduling for emergencies – making sure any issues are addressed quickly to avoid performance dips.

Routine maintenance helps prevent energy waste, which can lead to higher utility bills and shorten the lifespan of your equipment. For more focused care, the CRAWL SPACE & ATTIC CARE™ plan, available for $199, includes insulation checks and rodent inspections. These services help protect your weatherization improvements, which can save around 15% on heating and cooling costs.

Conclusion

Key Takeaways for Seattle Homeowners

If you’re a Seattle homeowner, tapping into energy rebates is easier than you might think. Start by confirming your eligibility as a customer of Seattle City Light or Puget Sound Energy. For households earning between 81% and 150% of the Area Median Income, there’s an extra incentive – an additional $4,000 in bonus rebates on top of the base amount.

Before beginning any work, make sure to get pre-approval, especially for Washington State IRA programs, as retroactive rebates aren’t offered. Work with participating contractors to take advantage of instant rebates that are applied directly to your invoice. To stay compliant, ensure your equipment meets ENERGY STAR and SEER2/HSPF2 standards. And don’t forget to gather at least three bids to ensure you’re getting a fair price.

The potential savings are impressive. Heat pumps can cut heating costs by 25% to 50%, while switching from oil to electric heating can slash annual heating bills by more than 50%. Pairing local utility rebates with federal tax credits can make a single heat pump installation eligible for thousands of dollars in savings. Proper documentation and hiring certified contractors are essential to securing these benefits and achieving long-term savings.

For even greater efficiency, professional guidance can make a big difference. Envirosmart Solution simplifies the process by identifying rebates, handling paperwork, and applying instant discounts. They ensure your equipment meets necessary standards, and their maintenance plans – such as the SMART GOLD™ package for $699 – keep your systems running smoothly. This plan also offers perks like 20% off additional services and priority emergency scheduling.

FAQs

What do I need to qualify for energy-efficient rebates from Seattle City Light?

To take advantage of energy-efficient rebates offered by Seattle City Light, your home needs to meet certain criteria. These often include upgrades such as energy-efficient heating and cooling systems, weatherization improvements, or lighting enhancements. Additionally, some rebate programs require your home to rely on electric space heating or an electric resistance heating system as the main heat source.

Since eligibility requirements can differ based on the specific rebate program, it’s crucial to review the guidelines for your particular project. Feeling overwhelmed? Envirosmart Solution can guide you through the process, helping you make the most of the rebates and incentives available while boosting your home’s energy efficiency.

How can I save the most by combining local rebates and federal tax credits for energy-efficient upgrades?

To save money on energy-efficient home upgrades in the Seattle area, you can stack local utility rebates with federal tax credits. Programs from providers like Seattle City Light and PSE offer rebates for upgrades such as energy-efficient windows, insulation, and HVAC systems. On top of that, federal tax credits – like the 25C Energy-Efficient Home Improvement Tax Credit – can cut costs even further for qualifying improvements, including HVAC replacements and insulation.

Getting the most out of these programs requires careful planning. Make sure your upgrades meet the eligibility criteria for both local rebates and federal tax credits. Working with knowledgeable contractors and tax professionals can help you confirm your upgrades qualify and ensure you claim every available savings. By leveraging these incentives, you can reduce upfront expenses, lower your energy bills, and create a more comfortable, energy-efficient home.

What should I do to make sure my equipment qualifies for energy-efficient rebates in Seattle?

To make sure your equipment qualifies for energy-efficient rebates, start by verifying that it meets the program’s specific requirements. This often includes being ENERGY STAR® certified or meeting certain efficiency benchmarks. Review the rebate guidelines thoroughly before making your purchase to avoid any surprises.

Keep track of all the necessary paperwork, such as receipts with purchase dates, model numbers, and installation details. For HVAC systems, an AHRI certificate may also be required. Once your equipment is installed, submit your rebate application along with all the required documents before the program’s deadline.

Additionally, ensure the installation complies with local codes and the rebate program’s standards. If you’re unsure about any step or want assistance in maximizing your rebates, consider reaching out to a professional service like Envirosmart Solution. They specialize in energy efficiency upgrades and rebate support, particularly in the Pacific Northwest.

Related Blog Posts

- Energy Audit Rebates in Washington State

- Smart Thermostat Rebates In Seattle 2025

- Best Rebates for HVAC Upgrades in Seattle

- Ultimate Guide to Energy Efficiency Rebates in Seattle