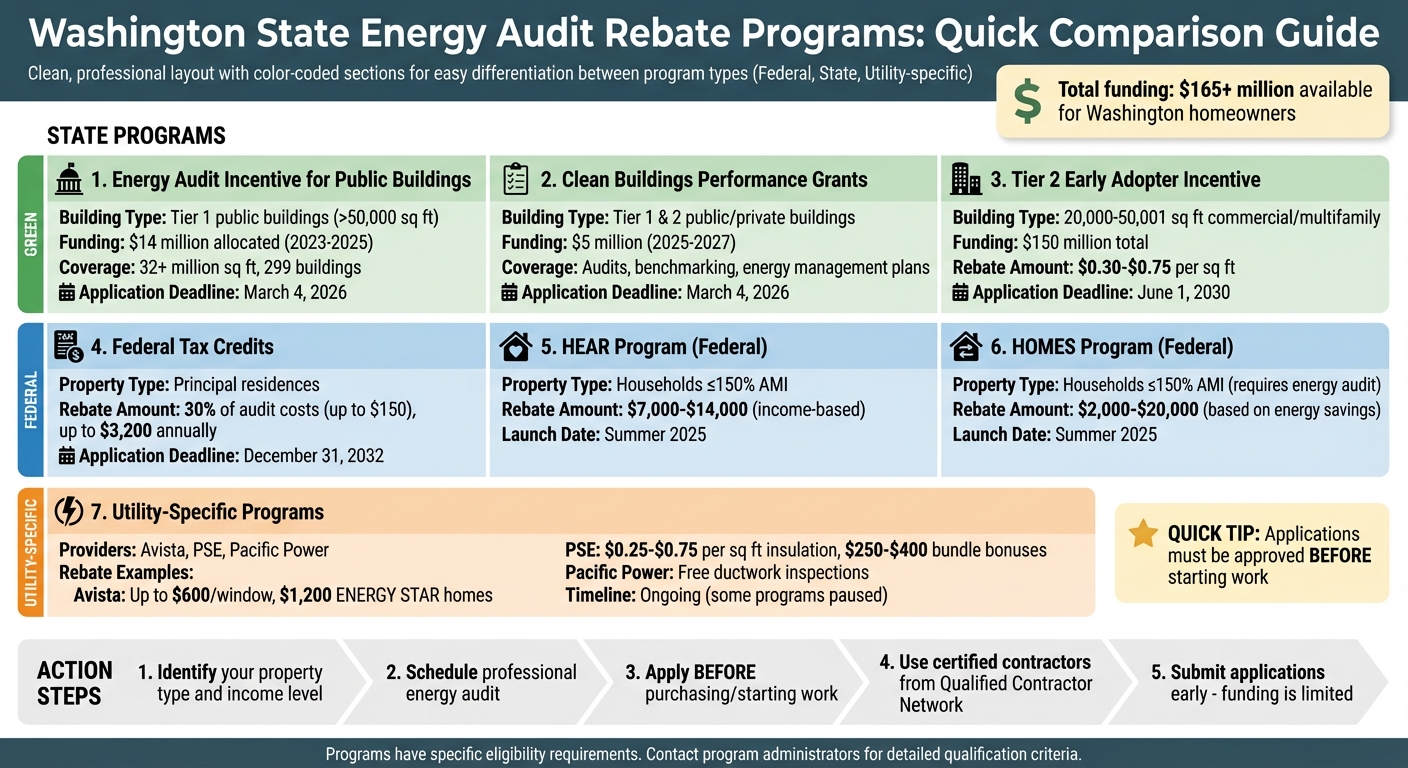

Washington State offers various programs to make energy audits and efficiency upgrades more affordable. These initiatives aim to reduce energy costs, improve home performance, and support compliance with state and federal standards. Key programs include:

- State Rebates for Public Buildings: Over $14 million allocated for energy audits of Tier 1 public buildings, covering over 32 million square feet.

- Federal Tax Credits: Homeowners can claim 30% of audit costs, up to $150.

- HEAR Program: Tailored for households earning up to 150% of the Area Median Income (AMI), offering rebates for electrification and appliance upgrades.

- Clean Buildings Performance Grants: Competitive funding for compliance-related activities like audits and energy management plans.

- Tier 2 Incentives: $150 million for medium-sized buildings (20,000–50,001 sq. ft.), with rebates ranging from $0.30 to $0.75 per square foot.

- Utility-Specific Rebates: Programs from Avista, Puget Sound Energy, and Pacific Power provide additional savings for insulation, ductwork, and appliance upgrades.

To qualify, applications must be approved before starting projects, and many programs require work by certified contractors. Act quickly, as funding is limited and demand is high.

Washington State Energy Audit Rebate Programs Comparison Guide

- How Home Energy Audits Work

- 1. Envirosmart Solution Energy Efficiency Support Services

- 2. Energy Audit Incentive for Public Buildings Program

- 3. Clean Buildings Performance Grants Program

- 4. Tier 2 Building Incentives

- 5. Federal Home Energy Rebate Programs

- 6. Utility-Specific Rebate Programs

- Program Comparison Table

- Conclusion

- FAQs

- Related Blog Posts

How Home Energy Audits Work

1. Envirosmart Solution Energy Efficiency Support Services

![]()

Navigating Washington’s energy rebate programs can feel overwhelming, but Envirosmart Solution simplifies the process by helping homeowners manage applications and meet administrative requirements. Here’s a closer look at how the application process works and what it takes to qualify.

Application Process

The first step is identifying your local program administrator. For the Home Electrification and Appliance Rebates (HEAR) program, you can email HomeRebates@commerce.wa.gov with the subject line "State Home Electrification and Appliance Rebates (HEAR) Program" to find out who oversees applications in your area. Since third-party administrators handle these applications, the process may differ depending on your location.

Envirosmart Solution also connects homeowners with the Home Energy Rebates Qualified Contractor Network (QCN). This network ensures that installations meet the necessary ENERGY STAR or AHRI certifications required for rebate eligibility.

Eligibility Requirements

The HEAR program is designed for households earning up to 150% of the Area Median Income (AMI). Partnering with a knowledgeable service like Envirosmart Solution can help you determine which rebate programs match your income level and property type. This personalized guidance can save you time by steering you away from programs you might not qualify for.

2. Energy Audit Incentive for Public Buildings Program

This initiative focuses on public buildings in Washington State that are required to meet CBPS standards. Between 2023 and 2025, the Washington State Department of Commerce allocated $14,014,159.68 to help 299 Tier 1 public building owners conduct ASHRAE Level 1, 2, or targeted Level 2 energy audits. This funding covered more than 32 million square feet of space, including 218 public K-12 schools, with 52 buildings located in Spokane County alone.

Eligibility Requirements

The program is open to Tier 1 buildings – these include non-residential spaces, hotels, motels, and dormitories that exceed 50,000 square feet. Eligible buildings must either comply with CBPS or qualify for the Early Adopter Incentive Program. The energy audits funded through this program are essential for qualifying for early adopter incentives and ensuring compliance with CBPS.

Rebate or Incentive Amount

In previous funding cycles, the program allocated between $12.8 million and $14.5 million to cover energy audit costs. While the per-building funding limits for the next cycle have not been announced, the program is specifically designed to assist building owners who face financial challenges in completing the energy audits required for CBPS compliance.

Application Process

Applications are submitted through a unified Request for Application (RFA) process that includes benchmarking, energy management, operations, and ASHRAE energy audits. Applicants must complete the "Form D Energy Audit Template" provided by the Department of Commerce. Any questions or technical issues can be addressed via the CBPS Customer Support Forms Portal on Smartsheet.

Program Availability or Timeline

The next RFA will open on March 4, 2026. A proposal conference for new applicants is scheduled for January 28, 2026, from 12–1 p.m.. Keep an eye on the Department of Commerce website for updates and ensure applications are submitted by the March 4 deadline.

3. Clean Buildings Performance Grants Program

This program builds on earlier rebate initiatives, focusing on helping building owners meet compliance reporting requirements under the Clean Buildings Performance Standard (CBPS).

The Clean Buildings Performance Grants (CBPG) program offers competitive funding to assist building owners with the costs of meeting CBPS requirements. For the 2025–2027 biennium, the program specifically reimburses expenses related to compliance reporting, such as energy audits, benchmarking, and creating energy management, operations, and maintenance plans.

Eligibility Requirements

The program supports a range of building types, including:

- Privately owned Tier 1 buildings that qualify for audit reimbursement.

- Tier 2 multifamily properties financed by the Washington State Housing Trust.

- All Tier 1 and Tier 2 publicly owned buildings.

Eligible activities include ASHRAE energy audits, benchmarking, energy management plan (EMP) development, and operations and maintenance (O&M) program creation.

Rebate or Incentive Amount

The program has approximately $5 million available for the 2025–2027 period, a significant reduction from the previous biennium’s $40 million. Funding is provided on a competitive reimbursement basis, meaning not all applicants will receive the full amount they request. Reimbursement covers professional services like audits, benchmarking, and plan development.

Application Process

Applications are submitted through a unified Request for Applications (RFA) process that integrates four funding sources. Applicants should prepare their documentation using tools such as the Energy Star Portfolio Manager and the Clean Buildings Portal. For questions, contact CBPSGrants@commerce.wa.gov.

Program Availability or Timeline

Applications for the 2025–2027 biennium must be submitted by March 4, 2026. The program is currently accepting applications for the Clean Buildings Compliance Support opportunity. Given the limited funding and competitive nature of the program, early submissions are strongly recommended.

4. Tier 2 Building Incentives

The Tier 2 Early Adopter Incentive Program, which launched on July 1, 2025, allocates $150 million to support owners of medium-sized commercial and multifamily buildings ranging from 20,000 to 50,001 square feet.

Eligibility Requirements

To participate, your building must fall within the size range of 20,000 to 50,001 square feet and be served by a qualifying electric, gas, or thermal utility. Utilities with over 25,000 customers are required to participate, while smaller utilities can choose to opt in. You can confirm your utility provider’s participation through the Department of Commerce’s official list.

Additional requirements include benchmarking your building’s energy use, establishing an energy use intensity target (EUIt), and creating both an energy management plan and an operations and maintenance (O&M) program. At this stage, only the EUIt identification is mandatory. This simplified process ensures that you can quickly determine your eligibility and move forward to access financial incentives.

Rebate or Incentive Amount

The program offers a base incentive of $0.30 per square foot of gross floor area, excluding parking and unconditioned spaces. For instance, a 30,000-square-foot building would earn $9,000. Multifamily properties can qualify for a higher rate – $0.75 per square foot or the actual cost, whichever is lower – if they sign an Anti-Displacement Agreement. Using the same example, a 30,000-square-foot multifamily building could receive up to $22,500. These incentives provide a significant financial boost for eligible properties.

Application Process

Applications are submitted through the Clean Buildings Portal. The Commerce Department handles the review process, while participating utilities issue the incentive payments directly. Be sure to include a completed W9 form and, for multifamily properties, a signed Anti-Displacement Agreement (Exhibit A). Incentives are awarded on a first-come, first-served basis until the $150 million pool is fully allocated. For additional support, Clean Buildings staff hold open office hours every fourth Tuesday of the month from 10:00 AM to 11:00 AM to address any questions.

Program Availability or Timeline

The program remains open until the $150 million fund is depleted. If your building is served by multiple utilities, the incentive payments will be divided based on each utility’s share of the building’s energy use.

sbb-itb-8db64ac

5. Federal Home Energy Rebate Programs

The Inflation Reduction Act has allocated a massive $500 billion to support clean energy initiatives, including two rebate programs specifically designed for Washington homeowners: HARP and HOMES. Washington State has secured over $165 million from the Department of Energy to fund these programs, with administration handled by Guidehouse. The programs are expected to roll out statewide by summer 2025. Here’s a closer look at the eligibility criteria and benefits.

Eligibility Requirements

Eligibility for these rebates depends on your income, measured against the Area Median Income (AMI). Homeowners, renters, and multifamily property owners earning up to 150% of their county’s AMI are eligible. Importantly, 50% of the program’s funds are reserved for households earning less than 80% of the AMI. To find out where you stand, check your county’s specific AMI thresholds.

For the HOMES program, an energy audit is mandatory. Conducted by a qualified contractor, this audit evaluates your home’s current energy efficiency and outlines a plan to reduce energy use by at least 20%. Keep in mind, rebates are not retroactive – you must get approval before making any purchases or starting upgrades.

Rebate or Incentive Amount

HARP focuses on providing rebates for ENERGY STAR-certified appliances like heat pumps and electric stoves. Households earning less than 80% of the AMI can qualify for rebates of up to $14,000, while those earning between 80% and 150% of the AMI may receive up to $7,000.

The HOMES program goes a step further, offering rewards for whole-home retrofits that achieve significant energy savings. The rebate amount depends on the percentage of energy reduction and your income level. Low-income households can receive up to 100% of project costs, with maximum rebates ranging between $15,000 and $20,000, depending on energy savings achieved. Moderate-income households can expect 50% cost coverage, with rebates ranging from $2,000 to $4,000.

Application Process

Applications for these programs will open through Guidehouse when the statewide launch occurs in summer 2025. To qualify, you must apply and secure approval before purchasing equipment or starting any work. All work must be completed by contractors listed in the Home Energy Rebates Qualified Contractor Network to ensure compliance with federal standards. It’s also important to note that rebates are not guaranteed for projects completed before receiving program approval, as emphasized by Washington State Commerce.

6. Utility-Specific Rebate Programs

In addition to state and federal options, utility-specific programs provide tailored benefits for Washington homeowners. These programs, offered by major utility companies like Avista Utilities, Puget Sound Energy (PSE), and Pacific Power, deliver localized solutions that often feature quicker processing and simpler applications. By leveraging these utility-specific rebates, homeowners can access extra support that complements broader government initiatives.

Eligibility Requirements

Eligibility for utility programs varies, but most focus on existing single-family homes. For instance, Avista extends its programs to single-family homes, duplexes, triplexes, and fourplexes, allowing renters to participate with written landlord approval. PSE, on the other hand, limits rebates to existing single-family properties, excluding new construction and buildings with five or more units. If you’re a Pacific Power customer, free ductwork inspections are available, but only for electrically heated homes. Additionally, PSE applies property age restrictions for certain rebates: homes must have been permitted before 1990 for insulation rebates or before 2001 for duct sealing.

Rebate or Incentive Amount

Each utility company offers unique incentives:

- Avista provides a free home energy audit, which includes a crawl space-to-attic inspection, an infrared scan, and the installation of LED bulbs and water-saving fixtures. For an added $150, you can include a blower door test. Rebates go up to $600 per window and $1,200 for ENERGY STAR manufactured homes.

- PSE offers weatherization rebates based on square footage: $0.50 per square foot for attic insulation, $0.75 for wall insulation, and $0.25 for floor insulation. Additional rebates include up to $400 for duct sealing and insulation, and $0.10 per square foot for air sealing. Plus, homeowners completing multiple upgrades can earn bundle bonuses – $250 for three measures or $400 for four measures.

- Pacific Power provides no-cost ductwork inspections and sealing for qualifying customers. Be sure to check updated incentive tables, which took effect on January 1, 2026, to ensure your project meets the latest standards.

Application Process

Each utility has its own process for applying:

- Avista customers can apply online, email HomeEnergyAudit@avistacorp.com, or call 509-495-4728. To claim rebates for completed upgrades, contractor invoices can be submitted online, via email, fax, or mail.

- PSE encourages customers to contact an Energy Advisor at 1-800-562-1482 before starting any upgrades. Weatherization projects must be completed by an independent PSE Trade Ally or a Recommended Energy Professional to qualify.

- Pacific Power handles applications through the Wattsmart Homes Online Incentive Center, accessible via the My Account portal.

Program Availability or Timeline

Program availability and timelines vary by provider:

- Avista’s home energy audits in Washington are available as of January 2026, but expect a 2–3 month wait time, so it’s wise to schedule early. Note that Avista’s Home Insulation Program is currently paused due to high demand, so check for updates before planning insulation projects.

- PSE typically processes rebates within 4 to 6 weeks.

- Pacific Power implemented significant updates to its Wattsmart Homes program starting January 1, 2026, so ensure your project aligns with the new guidelines.

Program Comparison Table

Here’s a quick side-by-side look at some key rebate programs, including who qualifies, what they offer, and their deadlines.

| Program Name | Eligibility Requirements | Incentive/Funding | Application Deadline |

|---|---|---|---|

| Envirosmart Solution Energy Efficiency Support Services | Homeowners in Washington looking for energy upgrades and rebate assistance | Tailored project pricing and support to maximize rebates | Ongoing |

| Energy Audit Incentive for Public Buildings | Owners of public buildings | Funding to uncover cost-saving energy measures | Not specified |

| Clean Buildings Performance Grants | Both private and public building owners aiming for Clean Buildings compliance | Competitive funding opportunities | Varies (based on competition) |

| Tier 2 Early Adopter Incentive | Buildings between 20,000 and 50,001 sq. ft., including certain multifamily properties | Incentives ranging from $0.30 to $0.75 per sq. ft. | June 1, 2030 |

| Energy Efficient Home Improvement Credit (Federal) | Owners of principal residences (excludes rentals or new builds) | Up to $3,200 annually ($1,200 for audits/envelope; $2,000 for heat pumps) | December 31, 2032 |

| Avista Energy-Saving Home Upgrades | Income-qualified Avista customers | Free upgrades like insulation and air sealing | Ongoing |

| Avista Single-Family Rebates | Avista customers with existing homes (windows/doors) or new/existing homes (appliances) | Rebates between $100 and $1,200 depending on equipment | Ongoing |

Important Notes: Some programs may have income restrictions or require work through approved contractors – double-check the latest requirements before applying. Also, Avista’s Home Insulation Program temporarily stopped accepting applications in early 2026 due to high demand.

Use this table to pinpoint the best program for your project’s specific needs.

Conclusion

Homeowners in Washington State have access to various rebate programs designed to support energy-efficient upgrades. Federal tax credits can provide up to $3,200 annually, while utility programs may offer additional rebates for qualifying equipment. To get started, a professional energy audit is a crucial first step. This audit evaluates your home’s energy use, identifies inefficiencies, and helps prioritize upgrades that deliver the best return on investment.

With $73.5 million allocated for 2024–2025 and another $30.1 million expected for 2025–2027, demand for these programs is high. However, some utility programs are temporarily on hold, and applications through third-party channels must be submitted by February 5, 2026, at 4 p.m.. Acting quickly is key to taking advantage of these opportunities.

Each rebate program has its own rules regarding eligibility, certifications, and application processes. Importantly, applications must be approved before any work begins, as projects completed beforehand won’t qualify for rebates. Partnering with certified contractors, such as those in Washington’s Qualified Contractor Network, ensures that installations meet ENERGY STAR or AHRI standards and comply with program requirements.

Given the complexity of these programs, professional assistance can make a big difference. Envirosmart Solution specializes in helping homeowners maximize rebates while providing full-service energy efficiency solutions throughout the Pacific Northwest. Their team handles the paperwork and application process, making it easier for homeowners to secure every available incentive. From energy audits to services like insulation, HVAC upgrades, and air sealing, Envirosmart Solution simplifies the path to lower energy bills and a more comfortable home. Let their expertise guide you toward lasting energy savings and efficiency.

FAQs

Who is eligible for the HEAR program in Washington State?

To participate in the HEAR program in Washington State, you need to meet a few key requirements. First, you must be a resident of Washington and have an income that is less than 150% of the area’s median income. Additionally, you’ll need to show proof of either purchasing or planning to purchase eligible energy-efficient electric appliances. Be prepared to provide valid identification and proof of residence as part of the application process.

This initiative aims to assist homeowners in upgrading to energy-efficient options, so ensure you have all the required documents ready before starting your application.

How do I apply for the Clean Buildings Performance Grants in Washington State?

The Clean Buildings Performance Grants application process in Washington State runs during specific periods determined by the Department of Commerce. Currently, the most recent application window has closed, and submissions are under review. The announcement of successful applicants is scheduled for February 24, 2026.

If you’re planning to apply in the future, it’s a good idea to monitor updates from the Department of Commerce or contact them directly for details. Staying proactive ensures you’re ready when the next application period begins.

What home upgrades are eligible for utility rebates in Washington State?

Home upgrades in Washington State that might qualify for utility rebates include upgrades to heating systems, such as furnaces, ductless heat pumps, and traditional heat pumps. You may also find rebates available for insulation improvements and other energy efficiency retrofits.

Since rebate programs differ depending on your utility provider, it’s crucial to review the details and eligibility requirements specific to your location. To make the most of these opportunities, you might want to collaborate with a professional service provider who specializes in energy efficiency solutions.

Related Blog Posts

- Winter Home Energy Efficiency Checklist

- Home Energy Savings Calculator

- Payback Period vs. Lifetime Savings: Energy Upgrades

- Checklist for Federal Renewable Energy Tax Credit Eligibility