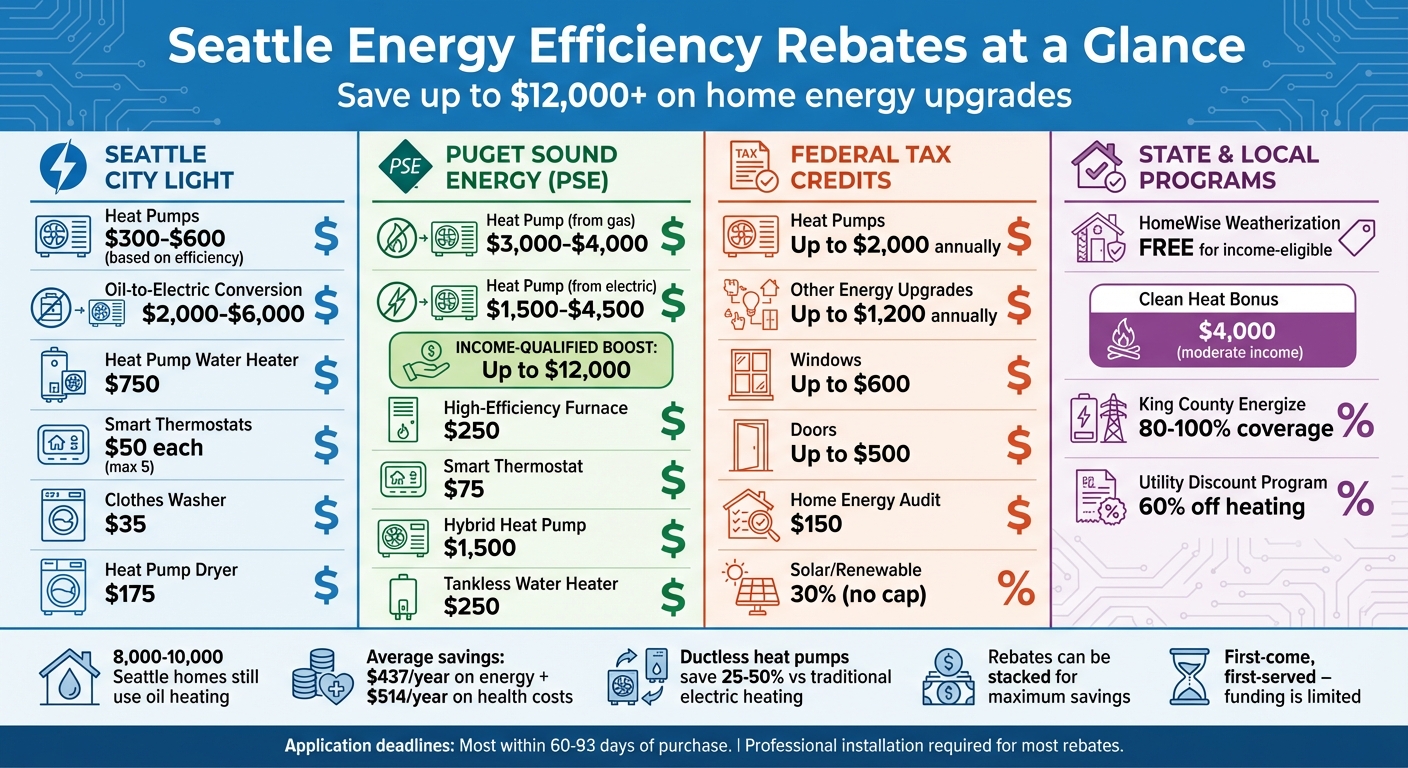

If you live in Seattle and want to cut down on energy costs while upgrading your home, energy efficiency rebates can help you save thousands. Programs from Seattle City Light, Puget Sound Energy (PSE), and federal tax credits make it easier and more affordable to install heat pumps, efficient water heaters, and smart thermostats. Here’s what you need to know:

- Seattle City Light Rebates: Up to $6,000 for oil-to-electric heat pump conversions, $750 for heat pump water heaters, and $50 per smart thermostat (max 5 units).

- PSE Rebates: $3,000–$4,500 for heat pumps depending on your current heating system, with income-qualified households eligible for up to $12,000.

- Federal Tax Credits: Up to $2,000 annually for heat pumps and $3,200 for other energy-efficient upgrades under the Inflation Reduction Act.

- State and Local Programs: Free upgrades for income-eligible households and additional rebates for weatherization and heating system replacements.

Most rebates are applied directly through contractors, and some programs even cover the full cost for qualifying households. With deadlines and funding limits, acting sooner can maximize your savings. Keep reading for detailed rebate amounts, eligibility, and application tips.

Seattle Energy Efficiency Rebates Comparison Guide 2024

- Mayor Harrell unveils bonus rebates for heat pump upgrades

- Seattle City Light Rebate Programs

- Puget Sound Energy (PSE) Rebate Programs

- Federal Energy Efficiency Tax Credits

- State and Local Rebate Programs

- How Envirosmart Solution Helps You Get More Rebates

- Eligibility Requirements and How to Apply

- Conclusion

- FAQs

- Related Blog Posts

Mayor Harrell unveils bonus rebates for heat pump upgrades

Seattle City Light Rebate Programs

Seattle City Light makes it easy to save on energy-efficient upgrades with three rebate options: instant contractor discounts applied directly to your invoice, digital coupons available at participating retail stores, or post-purchase rebate forms you can submit online within 93 days of purchase. These rebates cover a wide range of products, including heat pumps, water heaters, smart thermostats, and energy-efficient appliances. Let’s break down the available programs and how they can benefit you.

Home Energy Solutions and HomeWise Program

The HomeWise Weatherization Program is aimed at income-eligible homeowners and renters in the Seattle City Light service area. This program provides free energy efficiency upgrades, such as heating and cooling system replacements, insulation improvements, and other weatherization services. If you qualify based on income, you can make your home more energy-efficient without spending a dime.

Seattle Clean Heat Program

The Seattle Clean Heat Program is designed to help the 8,000 to 10,000 Seattle homes still relying on oil heating. The program offers a $2,000 instant rebate for switching from oil to an electric heat pump. For moderate-income households – those earning between 81% and 150% of the Area Median Income (e.g., $121,150 to $235,650 for a family of four) – an additional $4,000 bonus is available, bringing the total rebate to $6,000. For households earning below 80% of the Area Median Income, the Seattle Office of Housing may cover the entire cost of the conversion. To qualify, you’ll need to work with a participating contractor and properly decommission your oil tank following Seattle Fire Department guidelines.

Water Heater and ENERGY STAR Rebates

![]()

If you’re upgrading to a heat pump water heater, you can qualify for a $750 rebate by choosing an ENERGY STAR Tier 3 or 4 model. This rebate can be applied as an instant contractor discount, a digital coupon at participating retailers, or through an online post-purchase submission. Additional rebates include $35 for ENERGY STAR certified front-load clothes washers and $175 for BPA Tier 3 heat pump clothes dryers.

Smart Thermostat and Ductless Heat Pump Rebates

For homes heated with electric baseboard, fan-forced, or radiant ceiling systems, Seattle City Light offers $50 per unit for up to five smart line-voltage thermostats. These rebates are specifically for thermostats compatible with electric heating systems. If you’re considering an air source heat pump, rebates range from $300 to $600, depending on the system’s SEER2 and HSPF2 efficiency ratings. These discounts are available exclusively through participating contractors, and DIY installations do not qualify. To ensure you get the best deal, it’s recommended to obtain at least three quotes.

Puget Sound Energy (PSE) Rebate Programs

Puget Sound Energy (PSE) offers a range of rebates designed to make energy-efficient upgrades more affordable. These rebates can be combined with other incentives, such as those from Seattle City Light, to maximize savings. While PSE’s programs primarily target existing single-family homes, individual condo and townhome owners may qualify through the Multifamily Retrofit program. However, rebates are not available for new construction, ADUs, or commercial accounts.

One highlight is the Efficiency Boost program, which provides higher rebate amounts for income-qualified customers. Nearly half of PSE customers are eligible for these enhanced rebates. To determine eligibility, you’ll need to share details such as your household size, gross monthly income, and county of residence. Additionally, PSE collaborates with manufacturers, distributors, and contractors to offer upfront "pass-through" discounts on high-efficiency heat pumps, helping to lower initial costs.

Before starting any project, it’s a good idea to consult a PSE Energy Advisor by calling 1-800-562-1482 for tailored advice. You can also explore the PSE Marketplace to check for instant rebates at the point of purchase. Keep in mind, rebate applications must be submitted within 60 days of purchase, and processing typically takes 4 to 6 weeks. Below, you’ll find details on rebates for heat pumps, furnaces, and HVAC systems.

Heat Pump Installation Rebates

PSE offers generous rebates for switching to heat pump technology. If you’re converting from natural gas heating, you can receive $3,000 for both ducted and ductless air-source heat pumps, with income-qualified households eligible for $4,000 through the Efficiency Boost program. For those upgrading from electric resistance heating, rebates range from $1,500 to $4,500, while Efficiency Boost customers may qualify for up to $12,000.

To be eligible, the heat pump must meet AHRI certification standards, with an HSPF2 rating of at least 8.1 for ducted systems and 9.5 for ductless systems. Gas-to-electric conversions require the complete removal or decommissioning (cut and capped) of existing gas heating equipment. For ductless systems, at least one indoor unit must be installed in a main living area; systems limited to bedrooms do not qualify. Manufactured homes often qualify for higher standard rebates, with amounts reaching $4,000 for heat pump conversions.

High-Efficiency Furnace Rebates

Upgrading your natural gas furnace to a high-efficiency model can earn you a $250 rebate. Additionally, installing a smart thermostat to optimize your heating system qualifies for a $75 rebate.

Air Conditioner and HVAC Rebates

PSE’s HVAC rebates cover cooling systems and hybrid setups. Hybrid heat pumps, which combine electric heat pump technology with a natural gas backup, are eligible for a $1,500 rebate. This setup provides the energy efficiency of a heat pump while ensuring reliable heating during colder weather. Rebates are also available for natural gas tankless water heaters, offering $250 to help reduce water heating costs and save space.

When upgrading your HVAC system, ask your contractor about "pass-through" discounts that PSE coordinates with manufacturers and distributors. These discounts are separate from rebates and can significantly reduce upfront costs. Many qualifying heat pumps also meet the requirements for a $2,000 federal tax credit under the Inflation Reduction Act, allowing you to stack multiple savings opportunities.

Federal Energy Efficiency Tax Credits

Federal tax credits are a great way to reduce the cost of energy-efficient home upgrades, especially when combined with local rebates. The Inflation Reduction Act provides two key tax credits: a 30% credit for home improvements (Section 25C) and a 30% credit for renewable energy installations (Section 25D). These credits can significantly lower the cost of projects like insulation, windows, HVAC systems, solar panels, and more, while working alongside local rebate programs to maximize savings.

Both credits offer a 30% benefit, but they differ in how they’re applied. The 25C credit is capped at $3,200 annually, with specific limits such as $2,000 for heat pumps or biomass stoves and $1,200 for other upgrades like windows and doors. On the other hand, the 25D credit has no annual or lifetime cap and allows unused credits to roll over into future tax years. For example, installing a $30,000 solar system could result in a $9,000 credit, applied over several years if needed.

When determining your eligible tax credit, subtract any rebates or subsidies you receive from the total project cost before applying the 30% rate. For instance, if you install a $7,000 heat pump and receive a $3,000 rebate from Puget Sound Energy, your eligible cost becomes $4,000, resulting in a $1,200 federal tax credit. Starting in 2025, claiming credits for heat pumps, water heaters, boilers, and furnaces will require a Qualified Manufacturer Identification Number (QMID) on IRS Form 5695.

Energy Efficient Home Improvement Credit

The 25C credit is available for upgrades to your primary residence in the U.S. It covers two main categories: building envelope improvements and residential energy property.

- Building Envelope Improvements: This includes exterior windows (up to $600 total), exterior doors (up to $250 per door, with a $500 maximum), and insulation with air sealing (up to $1,200). You can also claim up to $150 for a professional home energy audit, which can guide your upgrade decisions.

- Residential Energy Property: Eligible items include central air conditioners, gas furnaces, and electric panel upgrades, with a $600 cap for each. Heat pumps (air-source or water heater models) qualify for up to $2,000. Labor costs are covered for energy property installations like heat pumps and HVAC systems but not for building envelope upgrades such as windows or doors.

Since the 25C credit resets annually and has no lifetime cap, you can spread your projects across multiple years to maximize savings.

Residential Clean Energy Credit

The 25D credit provides a 30% rebate for renewable energy systems installed on any residence, with the exception of fuel cell property on second homes. Eligible systems include solar panels, wind turbines, geothermal heat pumps, and battery storage. Unlike the 25C credit, this one has no annual limit, and unused credits can be carried forward to future tax years.

The 30% rate remains in effect through 2032, dropping to 26% in 2033 and 22% in 2034. Notably, geothermal heat pumps qualify under the 25D credit, offering greater potential savings compared to the $2,000 cap under the 25C credit. To claim this credit, file IRS Form 5695 for the year the system becomes operational and keep all manufacturer certifications and receipts.

sbb-itb-8db64ac

State and Local Rebate Programs

Washington State and local initiatives provide additional financial support for energy-efficient upgrades, particularly aimed at helping low- and moderate-income households switch to more efficient heating systems.

Washington State Weatherization Assistance Program

![]()

Beyond utility rebates, state programs offer further cost reductions. Since 1980, the HomeWise Weatherization Program has provided free energy efficiency upgrades to eligible Seattle residents. Through this program, income-qualified homeowners and renters receive a detailed home energy audit and free professional installation of upgrades. Funding comes from federal, state, and local utility programs.

Eligible households can save between $18,000 and $23,000 in one-time costs through improvements like insulation, duct sealing, furnace repairs, ductless heat pump installations, and ENERGY STAR appliances. These upgrades not only cut annual heating and cooling expenses by around $437 but also reduce medical costs by approximately $514 each year. For every dollar invested, families see $2.78 in health and safety benefits.

To apply, residents need to provide:

- Their 10-digit Seattle City Light account number

- Proof of U.S. residency for all household members

- Three months of income documentation for household members over 19

- Address verification, such as a utility bill

Applications, which take about 30–40 minutes, can be submitted online via the Seattle City Light portal or mailed to the Seattle Office of Housing.

Seattle Office of Sustainability and Environment Programs

The Seattle Clean Heat Program focuses on replacing outdated heating oil systems, which are inefficient, expensive, and environmentally harmful. An estimated 8,000 to 10,000 homes in Seattle still rely on heating oil. Moderate-income households earning between 81% and 150% of the Area Median Income can receive an additional $4,000 rebate through the Washington State HEAR program, totaling $6,000 in savings. For instance, a family of four earning between $121,150 and $235,650 qualifies for this bonus rebate. Families below the lower income threshold may qualify for completely free conversions through the Office of Housing.

Households enrolled in the Utility Discount Program can also benefit from a 60% discount on electric heating costs and a 50% discount on water and sewer bills. Additionally, the Washington State Pollution Liability Insurance Agency offers grants of up to $75,000 to cover cleanup costs for heating oil leaks. King County adds to these opportunities with its own rebate and assistance programs.

King County Electrification Programs

The King County Energize Program provides heat pump installations and weatherization services for low- and moderate-income households, covering 80% to 100% of installation costs. While the program currently focuses on single-family homes in south King County, funding is also available for multifamily residences and community spaces throughout the county. King County has plans to expand funding for multifamily and community retrofits.

The King County Climate Office highlights the benefits of ductless heating systems:

"Ductless heating systems can save 25-50% in heating costs over traditional electric systems. They can save even more compared to oil heating systems".

To qualify for rebates, homeowners must use approved contractors. For those eligible for multiple programs, combining the Clean Heat rebate with King County Energize funding can cover nearly all installation costs, offering significant long-term energy savings.

How Envirosmart Solution Helps You Get More Rebates

![]()

Navigating Seattle’s energy rebates can feel overwhelming, but Envirosmart Solution makes the process straightforward by simplifying both installation and rebate applications to help you save more.

Energy Efficiency Services

Envirosmart Solution provides a range of services that align with Seattle’s key rebate programs. These include installing heat pumps, upgrading insulation, replacing HVAC systems, and improving weatherization. As a participating contractor with Seattle City Light and other utility programs, they apply instant contractor discounts directly to your project bid. This means you see reduced upfront costs right away – no waiting around for rebate checks to arrive.

For air source heat pumps, the discounts they offer depend on the system’s SEER2 and HSPF2 ratings. If you’re converting from oil to electric heating under the Seattle Clean Heat Program, they apply the rebates directly to your invoice. They ensure all installed equipment meets utility standards by using models from approved product lists and following the technical efficiency criteria for each rebate tier. This hands-on approach ensures you take advantage of every available incentive without the stress of managing multiple applications.

Rebate Application Assistance

Once the installation is complete, the paperwork begins – but Envirosmart takes care of it all. They handle the rebate documentation to make sure you receive every eligible incentive. This includes verifying equipment ratings, managing invoices, and ensuring compliance with requirements like oil tank decommissioning per Seattle Fire Department guidelines and the new 17-character Product Identification Number (PIN) regulation that starts in 2026.

Their expertise also helps you combine local rebates with federal tax credits for even greater savings. For example, installing a heat pump could qualify you for an instant discount from Seattle City Light and a federal tax credit of up to $2,000, significantly lowering your costs. Keep in mind, though, that professional installation by approved contractors is required – Seattle City Light rebates for heat pumps aren’t available for DIY projects.

Annual Maintenance Packages

Keeping your energy-efficient systems in top shape is just as important as installing them. Envirosmart Solution offers annual maintenance packages to ensure your systems maintain the high efficiency ratings needed for ongoing tax credit eligibility. Their FURNACE CARE™ package, priced at $199 per year, and the SMART GOLD™ package, which costs $699 annually and includes a 20% discount on additional services, cover essential tasks like furnace maintenance, air duct cleaning, dryer vent cleaning, and inspections of attics and crawl spaces. These services not only extend the life of your systems but also help homeowners save an average of $8,000 annually by lowering heating costs by 25% to 50% compared to standard electric heating systems.

Eligibility Requirements and How to Apply

To take advantage of the rebates mentioned earlier, it’s important to understand the eligibility criteria and application process for Seattle’s incentive programs.

First, you need to be a Seattle City Light (SCL) customer to qualify for these rebates. Both homeowners and renters are eligible, though renters may need landlord approval for significant upgrades. Additionally, the equipment you purchase must meet specific standards, such as being ENERGY STAR certified or meeting efficiency tiers like BPA Tier 3 or 4 for items like water heaters and dryers.

The application process depends on whether you work with a contractor or handle the installation yourself. For contractor-installed systems, like air-source heat pumps, the rebate is applied as an instant discount directly to your invoice by participating contractors. However, DIY installations generally don’t qualify for instant rebates. If you’re purchasing eligible items like heat pump water heaters, smart thermostats, or clothes washers for DIY installation, you’ll need to submit an online rebate form along with your retail invoice within 93 days of purchase. Be sure to check the Qualified Product List (QPL) before making your purchase.

For commercial customers, the process involves securing project approval from Seattle City Light before buying or installing any equipment to remain eligible for incentives. It’s also recommended to gather at least three bids to ensure competitive pricing.

It’s worth noting that rebates for smart thermostats apply only to homes with electric line-voltage heating, such as baseboard or radiant heating. If your home uses gas heating, you’ll need to apply through Puget Sound Energy instead. The rebate programs for smart thermostats and thermostatic shut-off valves are set to end on December 31, 2026.

Rebate Comparison Table

| Program | Rebate Amount | Eligibility | Application Method | Deadline |

|---|---|---|---|---|

| SCL Heat Pump | $300 – $600 | SCL customer; participating contractor | Instant discount | Ongoing |

| SCL Water Heater | $750 | SCL customer; ENERGY STAR Tier 3/4 | Instant or online form | 93 days from purchase |

| SCL Smart Thermostat | $50 (max 5 units) | SCL customer; electric baseboard heating | Instant (online retailer) | Through December 31, 2026 |

| Clean Heat Program | $2,000 – $6,000 | Seattle household; oil-to-electric conversion | Instant discount | Ongoing (while funding lasts) |

| HomeWise Program | Free upgrades | Income-eligible (below 80% AMI) | Application and home audit | None |

| Clothes Washer/Dryer | $35 – $175 | ENERGY STAR / BPA Tier 3 | Online rebate form | After purchase |

Use this table to compare programs and select the best option for your home upgrades. Each program offers unique benefits tailored to specific needs, so make sure to review the details carefully before applying.

Conclusion

Homeowners in Seattle have a great opportunity to save on energy efficiency upgrades through rebates that reduce upfront costs and lead to lower utility bills over time.

If you’re considering making upgrades, now’s the time to act. The Seattle Clean Heat Program offers bonuses, but funding is limited and available only while supplies last. With many programs operating on a first-come, first-served basis, there’s added incentive to move quickly.

To make the process even easier, Envirosmart Solution helps homeowners take full advantage of these rebates. As a participating contractor, they apply instant discounts directly to your invoice for heat pumps and water heaters, eliminating the wait for rebate checks. They also handle all the paperwork and ensure your equipment meets the required efficiency standards.

Beyond rebates, Envirosmart Solution provides additional services like insulation upgrades, air duct cleaning, and HVAC maintenance to improve your home’s overall energy performance. Their SMART GOLD™ annual maintenance package, priced at $699, ensures your systems operate efficiently year-round.

FAQs

What do I need to do to qualify for energy efficiency rebates from Seattle City Light?

To take advantage of Seattle City Light’s energy efficiency rebates, you’ll need to meet certain eligibility criteria. This might include qualifying for income-based programs like the HomeWise Program or purchasing approved energy-efficient equipment. Eligible equipment often includes LED fixtures, heat pumps, and HVAC systems that meet recognized standards such as ENERGY STAR® or DLC-certified and adhere to minimum efficiency requirements.

It’s also important to ensure your home or building aligns with the program’s specific guidelines. Keep in mind, rebate amounts can vary depending on the type of upgrade, so it’s worth reviewing the most current program details. For extra support, consider consulting with professionals who can guide you through the process and help you make the most of your savings.

How can I apply for federal tax credits for energy-efficient home upgrades?

If you’re planning to make your home more energy-efficient, you might qualify for federal tax credits. These credits apply to specific upgrades, such as installing heat pumps, adding insulation, or upgrading to solar panels. The program, managed by the IRS, is available until December 31, 2025.

Here’s how to get started:

- Keep Records: Save all receipts and manufacturer certifications for your purchases. These documents are essential for proving your eligibility.

- File the Right Form: When it’s time to file your taxes, use IRS Form 5695 to claim the Residential Energy Credits. This will directly lower your tax bill.

- Submit Documentation: Make sure to include all necessary paperwork with your tax return.

For the best results, consider working with a tax professional or regularly checking IRS guidelines to stay informed about any updates. These steps will help you take full advantage of these incentives while avoiding mistakes.

Are there deadlines or funding limits I should know about for energy efficiency rebates in Seattle?

Yes, rebate programs usually come with deadlines and funding caps that you’ll want to be aware of. For instance, some programs might only be available until their funds are fully allocated, while others could have strict application windows that close on specific dates. Checking the fine print for each program is crucial to avoid missing out.

These incentives can also shift over time, so staying informed about the latest options is essential if you want to maximize your savings. If you’re feeling overwhelmed or unsure where to begin, reaching out to experts can help you keep track of deadlines and take full advantage of the rebates available.

Related Blog Posts

- Home Energy Savings Calculator

- Energy Audit Rebates in Washington State

- Smart Thermostat Rebates In Seattle 2025

- Best Rebates for HVAC Upgrades in Seattle