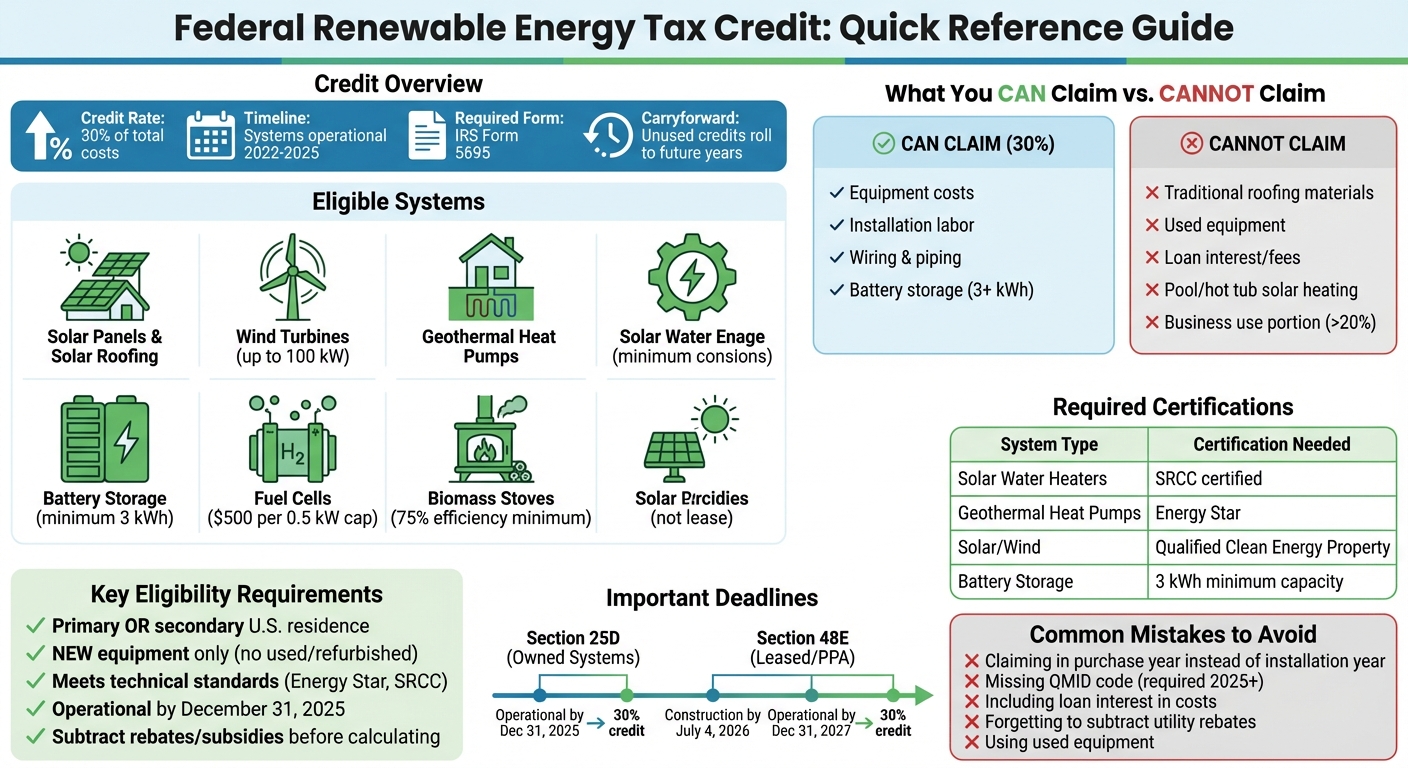

The Residential Clean Energy Credit (IRC Section 25D) provides a 30% federal tax credit for renewable energy systems like solar panels, wind turbines, geothermal heat pumps, fuel cells, and battery storage (3 kWh+). This credit applies to equipment and installation costs for systems made operational by December 31, 2025. Key eligibility factors include:

- Ownership: You must own (not lease) the system.

- Residences: Applies to primary and secondary homes in the U.S.

- Qualifying Equipment: Must meet technical standards (e.g., Energy Star for geothermal heat pumps).

- New Systems Only: Used or refurbished systems are not eligible.

- Business Use: If more than 20% of your home is used for business, the credit must be prorated.

- Rebates/Subsidies: Deduct these from costs before calculating the credit.

To claim, file IRS Form 5695 along with supporting documents like receipts and certifications. Unused credits can carry forward to future years. Systems installed after 2025 may qualify under different rules (e.g., Section 48E for leased systems).

- Property Ownership and Location Requirements

- Qualifying Renewable Energy Systems

- How Do Federal Solar Tax Credits Work? – CountyOffice.org

- Eligible and Ineligible Costs

- Installation Timing and Deadlines

- How to Claim the Tax Credit

- Common Mistakes That Disqualify Claims

- Next Steps for Homeowners

- FAQs

- Related Blog Posts

Quick Overview:

- Credit Rate: 30% (2022–2025)

- Deadline: Installed and operational by 12/31/2025

- Required Form: IRS Form 5695

- Eligible Systems: Solar, wind, geothermal, fuel cells, battery storage (3 kWh+)

Check your system’s compliance with technical standards, keep all documentation, and ensure installation timelines are met to secure your credit.

Federal Renewable Energy Tax Credit Eligibility Requirements and Deadlines

Property Ownership and Location Requirements

Owned vs. Leased Systems

To qualify for the federal renewable energy tax credit, you need to own the renewable energy system. Ownership means you either purchased the system outright or financed it and hold the title. If you’re leasing the system or have a power purchase agreement (PPA), the equipment owner – not you – will claim the credit.

Ownership rules vary depending on the type of property, which can impact your eligibility.

Property Types That Qualify

Once ownership is established, it’s essential to know which property types are eligible for the credit.

Both primary and secondary residences qualify, but fuel cell systems are limited to primary homes. Eligible structures include houses, houseboats, mobile homes, manufactured homes, condominiums, and cooperative apartments. If you live in a condo or co-op, you can claim a share of the costs for qualifying projects installed on the building, based on your ownership percentage.

It’s also important to ensure that the renewable energy system meets the technical standards required for the credit.

Community Solar Projects

Community solar projects may also qualify for the tax credit under prorated cost rules. If you’re part of a condominium association or cooperative housing corporation, your share of the project costs is considered paid, and your contribution is eligible. However, the project must generate electricity for a home in the United States that you use as your residence.

Qualifying Renewable Energy Systems

Approved Equipment Types

The federal tax credit covers a variety of renewable energy systems. For solar installations, eligible equipment includes solar panels, roofing tiles, and shingles specifically designed for energy production. However, panels mounted on standard shingles do not qualify. Solar water heaters are eligible if at least 50% of their energy comes directly from sunlight.

Wind turbines with a capacity of up to 100 kilowatts are covered. Geothermal heat pumps, which utilize the ground or groundwater for heating and cooling, also qualify. Battery storage systems must have a minimum capacity of 3 kilowatt-hours to be eligible. Fuel cells powered by renewable resources like hydrogen are eligible if installed in your primary residence. Additionally, biomass stoves and boilers must achieve at least 75% thermal efficiency to qualify.

The tax credit allows you to claim 30% of the costs for systems installed between 2022 and 2025, while battery storage systems became eligible starting in 2023. For fuel cells, the credit is capped at $500 per half kilowatt of capacity, with a combined limit of $1,667 per half kilowatt in multi-resident properties.

To ensure eligibility, review the requirements for new equipment and certifications.

New Equipment Requirement

Only new, original-use equipment qualifies for the tax credit. Used or refurbished systems are not eligible, and purchasing second-hand equipment will disqualify your entire claim. Be sure to keep all purchase receipts and installation records to verify that your equipment is new.

Required Certifications

Certain systems must meet specific certification standards to qualify. For instance:

- Solar water heaters must be certified by the Solar Rating Certification Corporation (SRCC) or a comparable state-approved organization.

- Geothermal heat pumps need to meet the Energy Star program requirements valid at the time of purchase.

- Solar electric panels and wind turbines must comply with "Qualified Clean Energy Property" standards.

It’s important to retain certification documents, such as SRCC verification for solar water heaters or current Energy Star certification for geothermal heat pumps, to support your claim.

| Equipment Type | Required Certification or Standard | Minimum Capacity |

|---|---|---|

| Solar Water Heaters | SRCC or state-endorsed entity | N/A |

| Geothermal Heat Pumps | Energy Star (current at time of purchase) | N/A |

| Battery Storage | N/A | 3 kilowatt-hours (kWh) |

| Fuel Cells | N/A | 0.5 kilowatts (kW) |

| Solar Electric / Wind | Qualified Clean Energy Property | N/A |

How Do Federal Solar Tax Credits Work? – CountyOffice.org

![]()

Eligible and Ineligible Costs

Now that you know which equipment qualifies, let’s dive into the project costs you can claim and how rebates might impact your final credit.

Costs You Can Claim

The federal tax credit allows you to claim 30% of eligible expenses for renewable energy systems. This includes the full cost of specific equipment like solar panels, solar roofing tiles or shingles that generate electricity, battery storage systems with a capacity of at least 3 kilowatt-hours, geothermal heat pumps, and small wind turbines.

Labor costs directly tied to the installation are also covered. These include onsite preparation, assembly, the original installation, and the necessary piping or wiring to connect the system to your home.

| Eligible Costs | Ineligible Costs |

|---|---|

| Solar panels and solar shingles/tiles | Traditional roofing materials (trusses, standard shingles) |

| Labor for onsite preparation, assembly, and installation | Interest paid or loan origination fees |

| Piping and wiring to connect the system to your home | Used or previously owned clean energy property |

| Battery storage systems (3 kWh or greater) | Solar water heating for pools or hot tubs |

| Geothermal heat pumps and small wind turbines | Costs for rental properties where the taxpayer does not reside |

Costs You Cannot Claim

Some expenses are excluded from the tax credit. For instance, traditional roofing materials like roof decking, rafters, trusses, or standard shingles don’t qualify since they don’t generate energy. Additionally, only new equipment is eligible – used or previously owned systems are not.

Financial costs, such as interest on loans or loan origination fees, cannot be claimed. Similarly, solar water heating systems for swimming pools or hot tubs are ineligible. If your home is used partially for business (more than 20%), you can only claim the portion of costs related to personal, non-business use.

How Rebates Affect Your Credit

Rebates and subsidies can influence the final amount of your tax credit. Public utility subsidies and manufacturer or installer rebates must be subtracted before calculating the 30% credit, as these are considered adjustments to the purchase price. However, state energy incentives only reduce qualified costs if they act as purchase-price adjustments. Payments from utilities for clean energy sold back to the grid through net metering don’t impact your qualified expenses. Always deduct rebates and subsidies first, then calculate the credit on the remaining amount.

sbb-itb-8db64ac

Installation Timing and Deadlines

Knowing when your system needs to be up and running is crucial if you want to take advantage of the federal tax credit. Missing the required deadlines could mean losing out on the tax savings you’re eligible for. Here’s a breakdown of the timing rules for both owned and leased systems.

System Must Be Operational by December 31, 2025

If you’re a homeowner planning to claim the residential ownership tax credit under Section 25D, your renewable energy system needed to be fully installed and generating power by December 31, 2025. Simply ordering equipment or starting construction wasn’t enough – the system had to be operational and connected to your home by that date to qualify for the 30% tax credit.

It’s also important to note that the tax credit applies to the year the system was installed, not the year it was purchased. For instance, solar panels delivered in December 2025 but installed in January 2026 wouldn’t qualify for the Section 25D credit.

For homeowners who opt for a lease or a Power Purchase Agreement (PPA), there’s a bit more flexibility. Under Section 48E, the Clean Electricity Investment Credit, a 30% incentive remains available through 2027.

Physical Work Test for Delayed Projects

If your project begins in 2026 and falls under a lease or PPA, the timing requirements shift to the installer. To qualify for the Section 48E credit, construction on your system must start before July 4, 2026. This means actual construction work – not just planning or permitting – must commence. The system must then be fully operational and in service by December 31, 2027.

| Credit Type | Ownership Model | Construction Deadline | Operational Deadline | Credit Rate |

|---|---|---|---|---|

| Section 25D | Homeowner Owned | N/A | Dec 31, 2025 | 30% (Expired) |

| Section 48E | Leased / PPA | July 4, 2026 | Dec 31, 2027 | 30% |

How to Claim the Tax Credit

Once your renewable energy system is up and running, you can claim your federal tax credit by filing your tax return with the appropriate forms and supporting documents. Here’s a breakdown of what you’ll need and how to navigate the process.

Documents You’ll Need

To claim your renewable energy tax credit, you’ll primarily need IRS Form 5695, "Residential Energy Credits." This form helps you calculate both the Residential Clean Energy Credit (Part I) and the Energy Efficient Home Improvement Credit (Part II). After determining the credit amount, you’ll transfer it from Form 5695 to Schedule 3, and then to your main tax return form – Form 1040, Form 1040-SR, or Form 1040-NR.

Before starting, make sure to gather these essential documents:

- Purchase receipts and installation records to verify costs.

- Manufacturer certifications for eligible equipment.

- If applicable, the Qualified Manufacturer Identification Number (QMID) for systems installed on or after January 1, 2025. This four-character alphanumeric code is provided by the manufacturer for qualifying items.

- For home energy audits conducted after January 1, 2024, you’ll need a written report that includes the auditor’s name, Taxpayer Identifying Number (TIN/EIN), and proof of certification by a Qualified Certification Program.

These materials not only support your claim but also help substantiate your home’s adjusted basis if you sell the property in the future.

Understanding Non-Refundable Credits

Renewable energy tax credits are non-refundable, meaning they reduce your tax bill dollar-for-dollar but won’t result in a cash refund. If your Residential Clean Energy Credit (Part I) exceeds your tax liability for the year, you can carry the unused portion forward to future tax years. For instance, if you owe $5,000 in taxes but qualify for a $7,000 solar credit, you’ll eliminate your current tax liability and carry the remaining $2,000 to the next year.

However, the Energy Efficient Home Improvement Credit (Part II) does not allow carryforward. Any unused portion of this credit is forfeited.

Completing Your Tax Forms

To calculate your Residential Clean Energy Credit, start with IRS Form 5695, which you can download from IRS.gov.

- Part I covers renewable energy systems, such as solar panels, wind turbines, geothermal heat pumps, fuel cells, and battery storage. Eligible costs include equipment, labor, wiring, and installation. Apply the 30% credit rate for systems placed in service from 2022 through 2025.

- Part II focuses on energy-efficient home improvements like insulation, windows, doors, and heat pumps.

After completing Form 5695, transfer the calculated credit to Schedule 3 (Form 1040), and then to your main tax return form (Form 1040, Form 1040-SR, or Form 1040-NR). If filing separately in a shared occupancy situation, include an allocation statement.

For specialized systems, such as fuel cells, note that the credit is capped at $500 per one-half kilowatt of capacity, so be sure to factor that into your calculations.

Common Mistakes That Disqualify Claims

Even small mistakes can throw off your tax credit claim. Knowing how to avoid common errors and maintaining proper documentation can help you secure the full credit you’re entitled to.

Eligibility Errors to Avoid

Only new equipment qualifies for the tax credit – so double-check that your system meets this key requirement before filing. Also, make sure to claim the credit in the year your system becomes operational, not the year you purchased it.

Homeowners sometimes misidentify what qualifies. For example, traditional roofing materials like standard shingles or roof trusses don’t count, even if they support solar panels. On the other hand, solar roofing tiles or shingles that actively generate electricity are eligible. Similarly, battery storage systems must have a capacity of at least 3 kilowatt hours to qualify.

If you use your home for business purposes more than 20% of the time, you’ll need to allocate expenses between residential and business use accurately. Failure to do so could lead to your claim being rejected or adjusted.

Eligibility is just the first step – complete and accurate documentation is also key.

Documentation Problems

Once you’ve confirmed your system qualifies, make sure your documentation is in order. Missing the QMID (Qualified Manufacturer Identification) on Form 5695 will disqualify your claim. Starting January 1, 2025, this four-character alphanumeric code is required for items like exterior doors, windows, skylights, and other energy-efficient property.

For home energy audits, the report must include specific details: the auditor’s name, their Employer Identification Number (EIN) or Taxpayer Identification Number (TIN), proof of certification from a Qualified Certification Program, and the name of that program. Submitting incomplete records will invalidate your claim.

Keep all Energy Star and National Fenestration Rating Council (NFRC) labels from items like windows and doors. These labels are essential for proving your equipment meets efficiency standards during an IRS audit.

Another common mistake is incorrectly including loan-related costs. Expenses like interest on financing or loan origination fees cannot be added to your qualified costs, but homeowners sometimes mistakenly include them.

Calculating Credits with Other Incentives

Accurately calculating your credit requires factoring in adjustments for other incentives. For instance, you must subtract public utility subsidies and manufacturer or installer rebates from your total project cost before applying the 30% credit. This applies even if the utility company paid the contractor directly instead of reimbursing you. Similarly, rebates tied to the system’s cost and provided by manufacturers or sellers must also be deducted.

State energy efficiency incentives, however, generally don’t reduce your federal credit calculation. Keep in mind, though, that these incentives might count as taxable income. Net metering credits – payments received for selling clean energy back to the grid – don’t affect your qualified expenses, as they are separate from installation subsidies and won’t reduce your federal credit.

| Incentive Type | Impact on Federal Tax Credit |

|---|---|

| Public Utility Subsidies | Must be subtracted from qualified expenses |

| Manufacturer/Seller Rebates | Must be subtracted if based on system cost |

| Net Metering Credits | No impact on qualified expenses |

| State Energy Incentives | Generally not subtracted; may be taxable income |

Next Steps for Homeowners

Key Eligibility Requirements

To determine if you qualify, start by reviewing your installation records and certifications. Your primary or secondary home in the U.S. is eligible if it’s powered by new, functional renewable energy systems like solar, wind, geothermal, fuel cells, or battery storage systems with a capacity of at least 3 kWh. It’s essential to keep all purchase and installation records handy for potential IRS review.

Your renewable energy system must be fully operational by December 31 of the tax year in which you’re claiming the credit. Eligible technologies include solar electric panels, solar water heaters, wind turbines, geothermal heat pumps, fuel cells, and battery storage systems meeting the 3 kWh minimum capacity requirement.

Although you won’t need to submit these documents with your tax return, the IRS may request them during an audit or to verify your property’s adjusted basis if you sell your home. When filing your annual return, use IRS Form 5695 to claim the credit.

Once you’ve confirmed your eligibility, consider teaming up with professionals to simplify the process and ensure everything is documented correctly.

Working with Energy Efficiency Experts

Collaborating with energy efficiency experts can help you navigate the technical requirements and take advantage of all available rebates. Companies like Envirosmart Solution specialize in helping homeowners maximize federal, state, and local incentives while ensuring installations meet certification standards. For example, geothermal heat pumps should meet Energy Star criteria, and solar water heaters need to align with Solar Rating Certification Corporation guidelines.

After consulting with an expert, establish a clear plan and timeline for your installation.

Planning Your Installation

Once you’ve consulted a professional, prioritize scheduling your installation early to meet the operational deadline. Your system must be fully installed and functional – not just ordered or partially set up – by December 31 to claim the credit for that tax year.

Account for potential delays in permitting, equipment delivery, and installation. Work closely with professionals who can manage the various aspects of your project to ensure your system is up and running before the year’s end. This proactive approach not only helps you meet deadlines but also ensures you take advantage of every incentive available.

FAQs

Can I still qualify for the federal tax credit if I lease my renewable energy system?

No, you can’t claim the federal renewable energy tax credit if you’re leasing your system. This credit is reserved for homeowners who buy and install the system themselves. When you lease, the company that owns the system is usually the one eligible for any tax benefits. Make sure to clarify ownership details before deciding on installation or financing options.

What documents do I need to claim the federal renewable energy tax credit?

To take advantage of the federal renewable energy tax credit, make sure to hold on to your purchase receipts and installation records for your eligible renewable energy system. When it’s time to file your taxes, you’ll need to fill out Form 5695 (Residential Energy Credits) and attach it to your tax return. It’s also a good idea to keep all related documents organized and accessible – not just for an audit but also for any future needs.

Do rebates or subsidies impact the amount I can claim for the federal renewable energy tax credit?

When it comes to claiming the federal renewable energy tax credit, rebates and subsidies don’t make you ineligible, but they do impact the amount you can claim. The credit is determined based on the net cost of your renewable energy system – essentially, the total cost minus any rebates or subsidies.

Here’s an example: Let’s say your system costs $20,000, and you receive a $2,000 rebate. In this case, the tax credit will be calculated on $18,000, which represents the amount you actually paid out of pocket. This approach ensures the credit aligns with your true expenses.

Related Blog Posts

- Winter Home Energy Efficiency Checklist

- Attic Insulation R-Value Calculator

- Home Energy Savings Calculator

- Payback Period vs. Lifetime Savings: Energy Upgrades