When weighing energy upgrades like solar panels, insulation, or HVAC systems, two key metrics matter most: payback period and lifetime savings.

- Payback period shows how long it takes for energy savings to cover the upfront cost. For example, attic insulation costing $3,000 with $300 annual savings has a 10-year payback period.

- Lifetime savings reflect the total financial gain over the equipment’s lifespan, often 15–30 years. That same insulation could save $6,000 in 20 years.

Factors affecting these metrics include:

- Home size (larger homes save more energy)

- Climate (cold climates see higher savings from insulation)

- Utility rates (higher rates shorten payback periods)

- Rebates & tax credits (federal credits cover up to 30%, state rebates up to $8,000)

Choose payback period for short-term decisions or limited budgets. Opt for lifetime savings for long-term investments like solar panels, which can save tens of thousands over decades.

Quick Tip: Combine upgrades with incentives to shorten payback periods and boost overall savings.

- Payback Period: How Quickly Your Investment Pays Off

- Lifetime Savings: Total Financial Returns Over Time

- Calculating Payback for Energy Improvements LIVE Stream Ask the Builder 11-16-2021

- Payback Period vs. Lifetime Savings: Which Metric to Use

- How to Use These Metrics for Your Home

- Conclusion

- FAQs

- Related Blog Posts

Payback Period: How Quickly Your Investment Pays Off

Definition and Calculation

The payback period measures how long it takes for the savings from an energy upgrade to cover its initial cost. In simpler terms, it answers the question: When will I break even?

The formula is straightforward: Payback Period = Initial Investment (after rebates and tax credits) ÷ Annual Energy Savings. For example, if you spend $2,400 on a heat pump water heater and save $200 annually on electricity, your payback period would be 12 years. To ensure accuracy, check the latest rates on your utility bills or with your provider.

For a more detailed calculation, consider factors like equipment efficiency, local Heating Degree Days, and insulation R-values. A study by the Department of Energy (DOE) found that upgrading attic insulation in average conditions had a payback period of 5.6 years.

Once you’ve calculated the payback period, it’s easier to see why this metric is so useful.

Benefits of Using Payback Period

The payback period stands out for its simplicity. It’s a quick and easy way to compare the cost-effectiveness of different energy upgrades without needing advanced financial knowledge. Whether you’re deciding between new windows or better attic insulation, this calculation can help steer you in the right direction.

This metric is especially handy if you’re working with a tight budget or planning to move soon. For instance, if you’re selling your home in five years, choosing an upgrade with a shorter payback period could make more sense. Additionally, if you’re financing the project with a low-interest loan, comparing your monthly energy savings to your loan payments can help you decide if the investment is worth it.

Drawbacks of Payback Period

While the payback period is simple, it has its flaws. One major limitation is that it only tells you when you’ll break even – it doesn’t account for savings beyond that point. For example, an upgrade with an 8-year payback period that lasts 20 years will provide an additional 12 years of savings, but this isn’t reflected in the basic calculation.

It also overlooks maintenance costs and potential equipment replacements. Plus, it assumes energy prices stay constant, which isn’t realistic since energy costs typically rise over time. A static calculation might not fully capture the true payback period when future price increases are factored in.

"Simple payback can skew the decision-making process because it doesn’t view equipment lifetime and long-term savings impacts." – Sabarish Vinod, Energy Engineer, Lincus Energy

Additionally, the payback period ignores non-financial benefits like better indoor air quality, enhanced comfort, and a healthier home. As Rick Barnett from Green Building Advisor aptly noted:

"Nobody ever asks what the payback period is for a granite countertop or an SUV!"

These shortcomings highlight the importance of looking beyond just the payback period. Considering both immediate and long-term savings is essential for making informed decisions about energy upgrades.

Lifetime Savings: Total Financial Returns Over Time

Definition and What Affects It

Lifetime savings refer to the total financial benefit you gain from an energy upgrade throughout its entire lifespan. To calculate this, subtract the initial investment from the total energy cost reductions achieved over the equipment’s useful life.

The lifespan of your equipment plays a major role in determining total savings. For instance, a refrigerator generally lasts around 12 years, HVAC systems have a lifespan of 15–25 years, and solar panels can produce energy for as long as 25–30 years. Additionally, local utility rates significantly impact savings. Homeowners in areas like the Northeast and Southern California, where energy costs are higher than average, often see greater lifetime savings. To get a complete picture of your financial returns, you also need to consider maintenance costs and eventual replacement expenses.

This broader perspective highlights why lifetime savings often provide deeper insights than simply looking at payback periods.

Why Lifetime Savings Matter

While the payback period offers a quick snapshot of when you’ll break even, lifetime savings show the long-term value of your investment. Large-scale upgrades, such as HVAC systems or solar panels, can generate substantial savings that compound over decades.

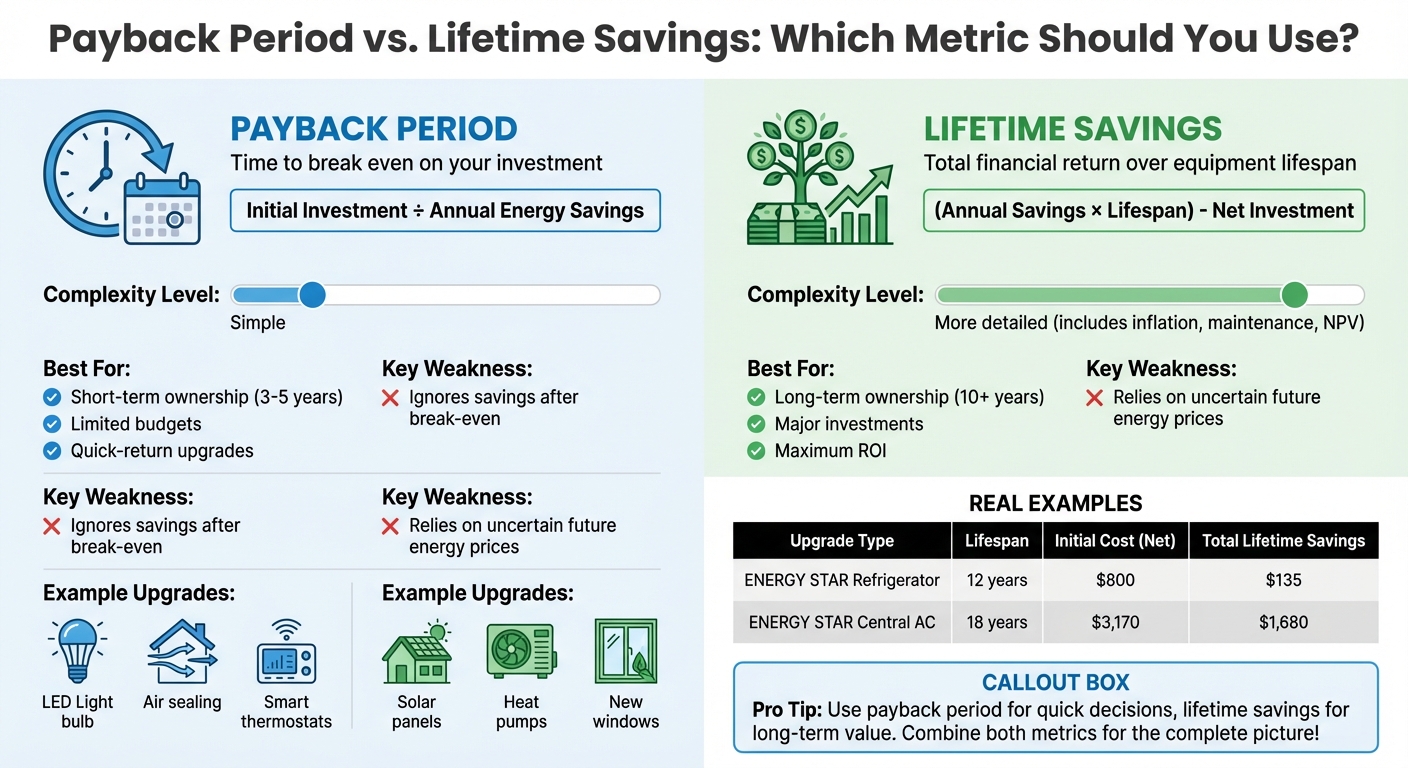

Here’s a simplified example comparing lifetime savings to upfront costs:

| Upgrade Type | Lifespan | Initial Cost (Net of Rebate) | Total Lifetime Savings |

|---|---|---|---|

| ENERGY STAR Refrigerator | 12 Years | $800 | $135 |

| ENERGY STAR Central AC | 18 Years | $3,170 | $1,680 |

Take the central AC as an example: after your initial $3,170 investment, you could see an additional $1,680 in savings over its 18-year lifespan.

Uncertainties to Consider

While lifetime savings calculations are valuable, they come with uncertainties. These estimates often rely on assumptions about future conditions. For example, residential electricity rates in the U.S. have risen by about 32% over the past decade, averaging a 2.8% annual increase. While such trends generally boost savings, predicting future rate changes is challenging.

Solar panels, for instance, are designed to last 25–30 years, and many retain 80–90% of their efficiency even after 25 years. However, factors like maintenance costs and efficiency loss over time must be considered.

"All you have to do is tweak your assumptions, and you can prove any conclusion you want." – Martin Holladay, Editor, Green Building Advisor

To avoid overly optimistic projections, it’s wise to use conservative assumptions in your calculations. For example, when estimating solar panel performance, consider a 0.5% annual efficiency loss and factor in a realistic 2.8% yearly rise in electricity costs. Additionally, don’t forget long-term maintenance expenses, such as inverter replacements, which can cost between $1,500 and $3,000 after 10–15 years.

Calculating Payback for Energy Improvements LIVE Stream Ask the Builder 11-16-2021

sbb-itb-8db64ac

Payback Period vs. Lifetime Savings: Which Metric to Use

Payback Period vs Lifetime Savings: Energy Upgrade Comparison Guide

Direct Comparison of Both Metrics

The payback period measures how quickly the savings from an upgrade cover its initial cost, while lifetime savings account for the total financial return over the equipment’s lifespan. Essentially, the payback period tells you when you’ll break even, while lifetime savings provide a broader picture, factoring in variables like energy price inflation and ongoing maintenance costs.

| Feature | Payback Period | Lifetime Savings (Includes inflation and maintenance) |

|---|---|---|

| Primary Focus | Break-even point (cost recovery) | Total financial return over time |

| Complexity | Simple (Cost ÷ Annual Savings) | More detailed (accounts for inflation, maintenance, NPV) |

| Best Use Case | Short-term ownership; limited budgets | Long-term ownership; major investments |

| Key Weakness | Ignores savings after break-even | Relies on uncertain future energy prices |

| Upgrade Examples | LED bulbs, air sealing, smart thermostats | Solar panels, heat pumps, new windows |

To calculate the payback period, divide your net investment by annual savings. On the other hand, determining lifetime savings requires a more in-depth analysis, incorporating factors like energy price trends, inflation, and maintenance costs.

When to Prioritize Payback Period

Choosing between these metrics depends on your specific situation. If you’re likely to move within three to five years, focusing on the payback period makes sense – it ensures you recover your investment before selling your home. This approach also benefits homeowners with limited upfront funds, as it emphasizes quick-return upgrades.

Certain improvements, like air sealing and insulation, provide some of the shortest payback periods. These upgrades can immediately lower heating and cooling bills by about 15%. Similarly, smart thermostats can cut heating and cooling costs by around 10% annually by adjusting temperatures by 7°–10°F for eight hours daily. LED lighting upgrades are another excellent option, delivering fast returns with minimal investment.

When to Prioritize Lifetime Savings

If you plan to stay in your home for 10 years or more, lifetime savings become the more meaningful metric. Larger investments, such as solar panels, offer substantial long-term returns.

High-efficiency HVAC systems and heat pumps also align well with a lifetime savings approach. Heat pumps, for example, can cut electricity use for heating by roughly 65% compared to electric resistance heating. They may even recoup about 104% of their cost when it’s time to sell your home. Additionally, rebates and incentives can improve both the payback period and overall lifetime savings.

If you’re financing upgrades, it’s critical to consider your monthly cash flow. Ensure your energy savings exceed your loan payments, as this practical factor often outweighs theoretical payback calculations. Timing major upgrades, like solar panel installation, with other planned maintenance – such as replacing your roof – can also help avoid extra costs down the line.

Next, we’ll dive into how to apply these metrics step-by-step for your home.

How to Use These Metrics for Your Home

Step-by-Step Evaluation Process

Start by scheduling a professional home energy assessment. This helps identify where energy is being lost and highlights upgrades that can make the biggest difference. To figure out the payback period for each improvement, divide the net cost (after rebates and tax credits) by the annual savings it provides. For a clearer picture of lifetime savings, multiply the annual energy savings by the expected lifespan of the upgrade, then subtract the net investment cost.

Focus on the most impactful areas first. For instance, tackle attic air sealing before adding insulation, then move on to areas like the basement, crawl spaces, and ductwork. Keep in mind that upgrades to doors, windows, and walls tend to have a smaller overall impact.

Finally, take advantage of available rebates and tax incentives to boost your return on investment.

Using Rebates and Incentives to Improve Returns

Federal tax credits and state rebates can significantly reduce upfront costs, making upgrades more affordable while shortening payback periods and increasing long-term savings. For example, heat pumps may qualify for a federal tax credit of 30% (up to $2,000 annually) and state rebates that can go as high as $8,000. To ensure eligibility, check equipment qualifications and point-of-sale discounts through the Home Energy Rebates Portal.

Planning upgrades across multiple tax years can help you maximize benefits. For instance, you could combine a heat pump credit with weatherization incentives to optimize savings. Don’t forget to use IRS Form 5695 to claim your federal tax credits.

How Envirosmart Solution Helps with Energy Upgrades

![]()

Envirosmart Solution simplifies the process of upgrading your home’s energy efficiency. They take a whole-house approach, identifying the best energy-saving opportunities while maximizing comfort and financial returns. Their expertise covers a range of high-impact upgrades, such as attic sealing, insulation, heat pump systems, and duct repair, ensuring these are installed correctly for peak efficiency and maximum lifetime savings.

The company also helps you navigate available incentives, coordinating federal tax credits with state rebates to reduce upfront costs. To maintain your investments, Envirosmart Solution offers annual maintenance packages like the CRAWL SPACE & ATTIC CARE™ and FURNACE CARE™ programs, each priced at $199. These plans help keep systems running efficiently and protect against performance issues that could erode savings over time.

From air sealing and insulation to full HVAC installations, Envirosmart Solution serves as a one-stop shop for optimizing your energy upgrades. Their services are designed to help you achieve a shorter payback period while maximizing your financial returns in the long run.

Conclusion

Energy upgrades bring two major financial benefits: a payback period – the time it takes to recover your initial investment – and lifetime savings, which represent the total financial gain over the system’s lifespan. For instance, a solar system with an average payback period of 10.5 years could generate around $57,000 in savings over 25 years.

When deciding on upgrades, think about your timeline. If you plan to sell your home within five years, focus on upgrades with a payback period of three years or less. On the other hand, if you’re staying put for the long haul, prioritize projects that maximize lifetime savings. Don’t overlook the added perks – improved comfort, better air quality, and factors like maintenance costs and rising energy prices.

Federal tax credits covering 30% of costs and state rebates of up to $8,000 can make these projects more affordable by cutting down upfront expenses. These financial incentives, paired with a step-by-step evaluation process, can help you make informed decisions about which upgrades align best with your goals.

To simplify the process, Envirosmart Solution offers whole-house assessments to identify the most effective energy efficiency opportunities tailored to your needs. Their team guides you through federal and state incentives, helping you prioritize upgrades based on financial returns and comfort. They also provide annual maintenance packages, like CRAWL SPACE & ATTIC CARE™ and FURNACE CARE™, each priced at $199, to protect your investment and ensure long-term savings.

Whether you’re aiming for a quick return or long-term benefits, Envirosmart Solution can help you choose upgrades that align with your financial goals while delivering value both now and in the future.

FAQs

How do rebates and tax credits affect the cost and savings of energy-efficient upgrades?

Rebates and tax credits can make energy-efficient upgrades much more approachable by significantly lowering the upfront costs. These incentives help reduce your initial spending, which in turn shortens the payback period – the time it takes for your energy savings to offset the net cost of the upgrade. For instance, if you’re looking at a $5,000 energy-efficient furnace, you might qualify for a $1,500 tax credit and a $1,000 rebate. That brings your out-of-pocket expense down to $2,500. With $500 in yearly energy savings, your payback period shrinks from 10 years to just 5.

But the benefits don’t stop there. These programs also boost your lifetime savings. By lowering the upfront cost, you end up saving more over the lifespan of the equipment, which is typically 15–20 years. Programs like the IRS Energy Efficient Home Improvement Credit and local rebate options directly cut your costs, leaving more money in your pocket over time.

For homeowners in the Pacific Northwest, Envirosmart Solution ensures you get the most out of these rebates and tax credits. They’ll help you find and qualify for the best options, so you can enjoy maximum savings and see a faster return on your investment.

How do I decide between payback period and lifetime savings when planning energy upgrades?

When weighing the payback period against lifetime savings for energy upgrades, it’s important to balance the upfront costs with the long-term benefits. The payback period measures how quickly your investment pays for itself through energy savings, while lifetime savings represent the total financial gain over the upgrade’s lifespan, including maintenance and replacement expenses.

Here are a few key factors that can shape your decision:

- Utility rates: If electricity or gas prices are high in your area, you’ll see greater yearly savings, which shortens the payback period and boosts overall returns.

- Rebates and incentives: Local and federal programs can lower initial costs, making upgrades with longer payback periods more worthwhile.

- Durability and warranties: Long-lasting solutions, such as high-efficiency HVAC systems, often deliver better long-term value compared to options with shorter lifespans.

- Additional benefits: Some upgrades go beyond energy savings by improving comfort, air quality, or preventing issues like mold, which can make a longer payback period easier to justify.

For homeowners in the Pacific Northwest, Envirosmart Solution provides expert advice to help you assess these factors. They’ll recommend upgrades with the best savings potential, guide you through available rebates, and ensure your investment enhances both your home’s efficiency and comfort – all while aligning with your financial goals.

How can I estimate the lifetime savings of an energy upgrade with changing energy prices?

To figure out the lifetime savings of an energy upgrade, start by taking a close look at your utility bill. Identify your rate schedule, which includes charges like generation, delivery, and fixed fees. Then, consider how energy prices might rise over time. You can base this on historical inflation rates (typically 2–4% annually) or forecasts from your utility provider. Using these projections, calculate how much your energy costs could decrease each year after the upgrade, factoring in efficiency improvements – like a 15% drop in heating or cooling expenses.

Don’t forget to consider long-term factors, such as equipment performance over time. For example, a furnace may lose about 1–2% efficiency per year. You should also factor in any maintenance savings. Add up these yearly savings over the expected lifespan of the equipment – usually 15–20 years for HVAC systems or insulation upgrades. To get a more precise estimate, you can apply a discount rate to calculate the present value of these future savings.

Since these calculations can get pretty complex, working with a professional can make things easier. For instance, Envirosmart Solution provides detailed energy analyses specifically for homes in the Pacific Northwest. They consider local utility rates, realistic assumptions, and available rebates, giving you a clear picture of your potential savings before you commit to any upgrades.

Related Blog Posts

- Winter Home Energy Efficiency Checklist

- Attic Insulation R-Value Calculator

- Home Energy Savings Calculator

- 5 Ways Poor Insulation Increases Energy Bills